If you just focus on core inflation, Wednesday’s inflation print would be a reason to celebrate good news.

Like a ball tossed into the air, inflation’s trajectory peaked and is neatly falling back to Earth.

To be fair, core inflation has been steadily dropping (apart from a small blip higher in March) since peaking last September.

But at 4.3%, core inflation is just 2.3% lower than the 6.6% high of this cycle.

This still leaves the Fed right at the crossroads at next week’s meeting.

Real Prices

Core inflation is the Fed’s preferred method to gauge inflation. But it excludes items like energy and food.

That has always struck me as a little odd.

After all, feeding your family and filling up your tank to get to work are at the forefront of most people’s minds.

On top of rent or mortgage payments, groceries and gas affect you directly every day.

These costs also determine how much you have left to spend on other things.

A look at the broader inflation data including food and energy shows a more mixed picture:

United States Inflation Rate – Annual

Source: TradingEconomics.com, U.S. Bureau of Labor Statistics

Real inflation fell from its 9.1% peak in June 2022 to 3% in June this year. That’s just 1% above the Fed’s inflation target. Yet now it has started to climb (red circle).

That might not flow into the Fed’s interest rate decision next week. But it does mean we can expect another rate rise or two if inflation continues to climb or stays near current levels.

Remember, 3.7% for real inflation and 4.2% for core inflation are around twice the Fed’s target.

Softer Jobs Market

Recent data showed a softer jobs market. That will likely cause the Fed to pause its hikes for now.

Job openings in July (the most recent data) came in at their lowest level since March 2021. And unemployment rose from 3.5% in July to 3.8% in August.

Yet if real inflation continues to jump, that could force the Fed’s hands.

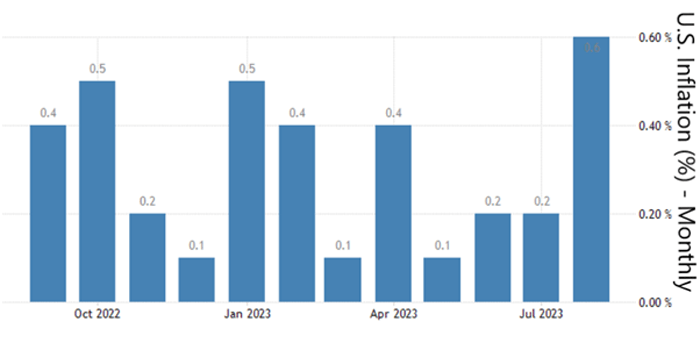

United States Inflation Rate – Month-Over-Month

Source: TradingEconomics.com, U.S. Bureau of Labor Statistics

As the chart shows, that 0.6% month-over-month rise in August came off of a 0.1% rise in May and 0.2% increases in June and July.

It’s also the largest monthly jump since June of last year.

And a big jump in gasoline (up 10.6% for the month) only accounted for half the overall monthly rise.

So it’s not just oil prices that are responsible for the recent ramp-up in real inflation.

Inflation Will Remain Sticky

Many folks associate the huge inflation in the 1970s with OPEC’s oil embargo with the U.S. And that’s partly true.

But the OPEC embargo only lasted around six months from October 1973 to March 1974. Inflation persisted into the early 1980s.

A huge increase in budget deficits in the early 1970s (funding the expanded Social Security program) drove inflation.

The 1970 recession was fresh on everyone’s minds. So the Fed was pressured to keep interest rates low to help boost the economy.

Temporary wage and price controls helped slow inflation. But when those controls were later scrapped, they only fueled inflation.

Inflation finally topped out just under 15% in April 1980, six years after the oil embargo was lifted.

Of course, our current situation is different. But there is something remarkably similar about the huge deficits, massively expanded Fed balance sheet, and low interest rate period that we’re emerging from.

And it seems the market is noticing.

|

Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |

Struggling to Make New Highs

The market rallied strongly this year due to the AI boom and the prospect that rate rises would taper off – and even drop.

Yet now the market is struggling to break higher. New buyers remain thin on the ground.

Don’t get me wrong. I’m not calling for a massive pullback.

Yet we’re coming into a traditional period of weakness. So traders need to be prepared to trade in both directions.

Markets typically overshoot. We should be ready to profit when they revert back the other way.

So if the market falls, we can trade any counter-rally. If we get our trades right, we’ll be quick to bank our profits when we see them.

Regards,

Larry Benedict

Editor, Trading With Larry Benedict