Larry’s Note: Over my career as a trader, I’ve legally “eavesdropped” on phone calls with major players like Elon Musk, Jensen Huang, and Larry Ellison.

On one such call, Elon Musk called a Wall Street analyst a “boring bonehead” – and that insult moved markets. Three months later, Musk apologized on another call – and set off another big move.

Each time CEOs get on these calls, they create opportunities. And if you know what to listen for, you can turn those market moves into profitable trades worth thousands of dollars.

That’s what I’ll discuss at my upcoming event, Wall Street Street Money Calls, on February 11 at 8 p.m. ET.

I’d love to have you join me there so I can explain how these calls work… the signals I look for… and how you can be sure you’re ready to take advantage of the next move. RSVP here now to automatically add your name to the attendee list.

One of the reasons I love trading currencies is that they have little correlation with stocks. That gives us more potential setups to profit from.

The currency market also has the deepest pockets in the world, with trillions of dollars changing hands every day. But while forex (foreign exchange) trading can be very lucrative, some folks find it confusing. They put it in the too-hard basket. But I think that’s a major mistake.

As we’ve already seen this year, geopolitical tensions have been rising around the globe. That volatility is opening up more forex trading opportunities.

In fact, just this week, we closed out a forex trade that netted my subscribers a tidy sum.

So today, I want to run through how that trade played out, which should allay any fears you might have about forex trading…

The key to understanding forex is that you are evaluating the strength of one currency against another. And there are several factors that markets consider…

One major theme is interest rates. So, for example, if rates are higher in one country than another, then money will flow into that currency as investors chase the higher yield. That will help the currency strengthen.

Another factor is economic performance. A strong and growing economy will see more capital flow into the country. If growth becomes too strong, that country’s central bank might have to raise interest rates to slow down demand. These things would strengthen the currency as well.

The opposite also applies. A struggling and slowing economy might see global players withdraw their capital. That can help force a central bank to lower rates to encourage domestic demand. These factors can cause the currency to soften.

Political and governmental stability also plays a major part. When stability diminishes, a currency can take a hit when investors look to park their funds in less risky jurisdictions.

This last factor helped lay the groundwork for our recent currency trade.

The USD sold off heavily in reaction to President Trump’s threats to put tariffs on European countries opposed to the U.S.’s “taking” of Greenland. That sparked concerns over a potential U.S.-European trade war.

Trump then threatened to issue tariffs on Canada if it signed any trade deals with China. He also failed to reassure people about the U.S. dollar while it was weakening. Markets took his words as a sign that the president was happy for the dollar to keep sinking (and “find its own level,” as he said).

That’s when the selling in the USD really sped up.

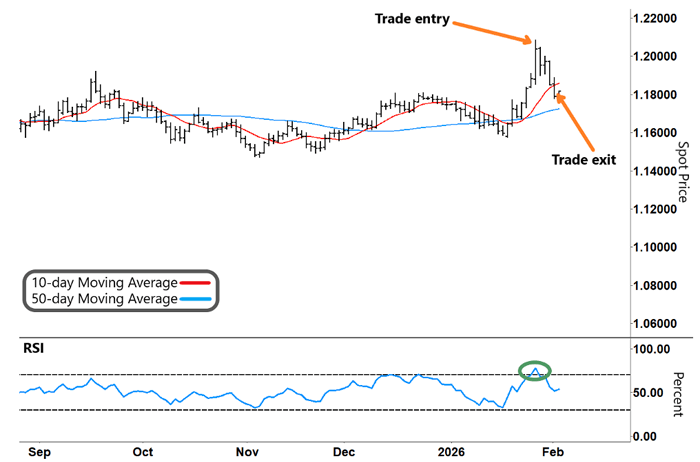

You can see that the rapid strengthening of the euro against the U.S. dollar (EUR/USD) in mid-January in the chart below…

EUR/USD Spot Price

Source: eSignal

Just as I look for stocks that overshoot for mean reversion opportunities, I can find similar moments in the currency market.

In this case, the euro had become so overbought compared to the dollar that it was ripe for a reversal. In short, I was looking for their relationship to snap back the other way…

The macro and fundamental factors of the dollar’s fall were overhyped. Plus, the sharp rally in the euro had pushed the Relative Strength Index (RSI) into overbought territory.

To capture a reversal, we opened a short EUR/USD position on January 27. That means we were looking for the euro to weaken against the USD. And as you can see, we got our timing spot on…

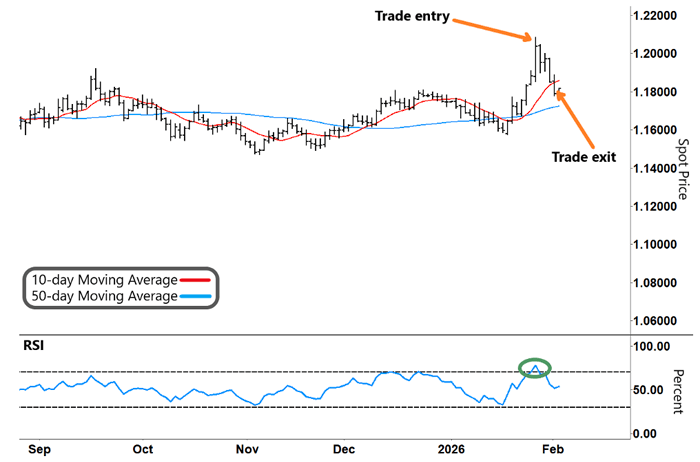

Take another look:

EUR/USD Spot Price

Source: eSignal

The RSI formed an inverse “V” (green circle) and retraced from overbought territory. That pushed EUR/USD lower and put our trade into profit.

With the RSI peppering support (the 50% level, where we might see some buying) and our trade in good profit, we decided to exit the position on Monday and bank our gains.

We generated 153 pips, which equates to a $1,530 profit for anyone trading a standard lot, in less than a week.

I know currency trading can seem confusing…

But if you break down the economic factors and the technical signals on the chart, you’ll soon start to see how it works.

Better still, with stocks getting dicey this year, it can give you another profitable market to trade.

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.