Federal Reserve Chair Jerome Powell had a surprise for investors.

The Fed has to balance inflation with the health of the job market. It typically uses interest rates to adjust to the current market conditions.

And Powell’s widely anticipated speech at the Fed’s Jackson Hole symposium revealed concerns about the labor market.

Powell referred to the current level of interest rates as being “restrictive”… meaning rates may be too high.

The central bank has been on hold with interest rates for over eight months. But Powell’s comments set the table for the Fed to resume cuts next month.

Stocks and cryptocurrencies soared following Powell’s comments. The S&P 500 rose by 1.5% while Bitcoin jumped by 4.0%.

But there’s a saying among traders: It’s “the reaction to the reaction” that’s most important.

And that’s why you should be concerned with the action in Bitcoin…

The Reaction to the Reaction

Major stock indexes are holding up following Powell’s remarks. But Bitcoin is wiping out the gains and then some.

Any time a stock or crypto can’t follow through on an initial price move, that’s pointing to a larger reversal in store.

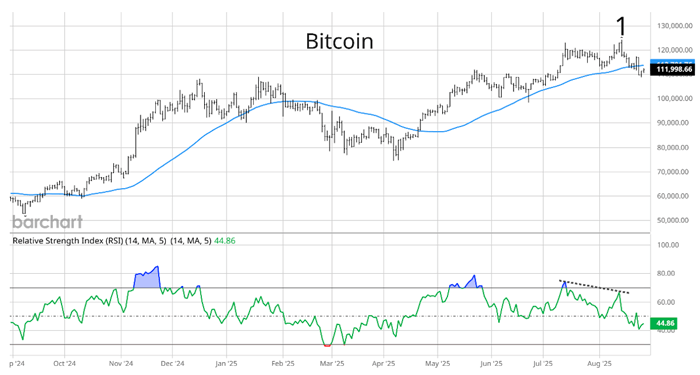

Plus, Bitcoin’s downside was already in the making. Take a look at the chart:

After briefly touching new highs over the $120,000 level at “1,” Bitcoin promptly reversed lower.

Waning momentum also flagged the potential for a pullback. As Bitcoin was jumping to new highs at “1,” the Relative Strength Index (RSI) in the bottom panel revealed weakness.

The RSI made a lower high (dashed line). That points to deteriorating momentum for Bitcoin’s rally.

Powell’s nod to rate cuts seemed to help Bitcoin jump back toward its prior highs. But rather than building on that surge, Bitcoin made an immediate reversal that’s taking out more key support levels.

Based on Bitcoin’s past behavior, that could be a warning for the rest of the stock market.

|

Tune in to Trading With Larry Live Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. |

Bitcoin’s Leading Action

Bitcoin, along with other cryptocurrencies, is a speculative asset… even more so than stocks.

Crypto price trends get amplified when investors are feeling extremely greedy or fearful. So when the mood sours on Bitcoin and its fellows, that’s a sign broader investor attitudes toward risk could be shifting.

As such, Bitcoin tends to lead key changes in the stock market’s direction. Since fear and greed often show up in Bitcoin before other markets, it can change direction before stocks follow.

For instance, heading into the stock market’s meltdown earlier this year, the price of Bitcoin topped out just under $107,000 on January 21. That was a month before the S&P 500 peaked on February 19.

Bitcoin also hinted at the rally off the April lows. While the S&P 500 was plunging in early April, Bitcoin only slightly undercut its prior low and showed relative strength.

Given Bitcoin’s tendency to lead changes in trend, it’s concerning that Bitcoin is losing key price support levels on this pullback.

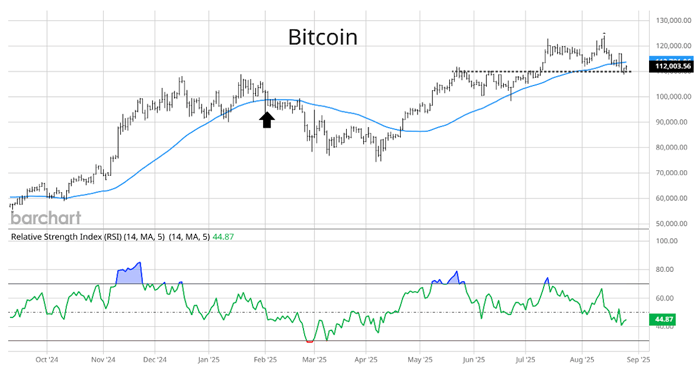

That includes the 50-day moving average (MA – blue line) in the chart below. Bitcoin broke down through that level after Powell’s speech.

Losing support at the 50-day MA can mark a change in trend. The last time Bitcoin made a cross below the 50-day back in February (arrow), the crypto went on to lose 20%.

Bitcoin’s next test is price support at the $110,000 level (dashed line), which was a key breakout level back in July.

If that level gives way, that could mark the next leg lower for Bitcoin – and warn of a change in direction for the stock market.

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

P.S. Bitcoin is known for extreme moves, which can make the prospect of a fall scary for holders. That’s one reason I spent time developing a way to profit from Bitcoin… without buying Bitcoin.

In fact, we’ve made some of our biggest profits as Bitcoin has taken a tumble.

If you want to learn how my “Bitcoin skimming” strategy works… and how you can get in on my next trade, then check out my presentation here.

|

Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |