Larry’s Note: The stock market is fundamentally different from how it used to be… and this transformation requires a different approach if you want to make serious money.

I’ve discovered how to collect double-digit gains over and over again – quickly (in days or weeks) – thanks to increasingly wild swings in the stock market.

You’ve seen how tech stocks soar one day and crash out the next. Gold and silver are experiencing some of their most dramatic moves in years. Bitcoin too is rising and falling with nerve-wracking swings.

If you want to navigate this kind of action successfully, you need the right strategy. That’s what I’m offering at my Get Rich Slow event on January 15 at 8 p.m. ET.

To attend, all you need to do is RSVP right here with one click. I’ll reveal everything you need to take part in the income stream I’ve found.

Over the weekend, President Trump ordered a military strike in Venezuela. The operation culminated in the capture of the country’s president, Nicolas Maduro.

The administration described the operation as an effort to counter narco-terrorism, with Maduro and his wife now being held on drug charges in New York.

But the interest in Venezuela extends far beyond stemming the flow of illicit drugs.

Venezuela used to be the largest exporter of oil in the world, and it ranks first in the world for oil reserves… even ahead of Saudi Arabia.

As the news unfolded, investors were on edge with how oil would react. Following an initial sell-off, oil prices quickly reversed direction.

And now oil’s move could hint at a big trading opportunity…

Anytime a major oil-producing nation faces a geopolitical shock, most assume that oil prices will spike higher.

In the case of Venezuela, however, speculation spun the other way. Many thought that oil prices would embark on the next leg lower.

That’s because Venezuelan oil production has slowed to a trickle due to neglect of oil infrastructure, sanctions, and a collapsing economy. The country currently produces about one million barrels per day (bpd). That figure stood at over three million bpd 25 years ago.

The thought process is that if the U.S. can exert control over the country’s oil production, U.S. producers (several of which have established operations in Venezuela) could work to restore production. So when oil opened for trading following the military operation, the initial reaction was to sell off.

But those losses quickly reversed.

That’s significant. When prices in any asset stop going down on bad news (or up on good news), it’s time for traders to pay close attention.

If you trade short-term reversals like me, spotting this type of change in direction can be an early indicator of a reversal… and create a trading opportunity…

Oil news has been bearish for quite some time now.

When Trump assumed office nearly a year ago, his mantra of “drill, baby, drill” showed his desire to increase U.S. production to push oil prices lower. Trump also pressured the OPEC oil cartel to increase production. OPEC boosted production by 2.9 million bpd last year.

Even before the Venezuela news, the dominant oil headlines pointed to fears over a supply glut this year. The International Energy Agency is forecasting an oversupply of four million bpd this year, which is about 4% of global demand.

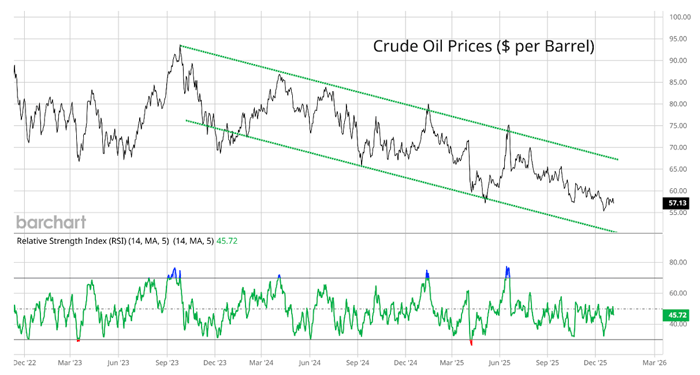

Those bearish developments kept oil prices locked in a downtrend. Here’s the chart below:

Oil prices have been stuck in an overall downtrend since late 2023, which you can see with the trend channel. While there have been plenty of whipsaws inside the channel, the price action has been mostly bearish for over two years.

But oil prices could stage a rally, even if it’s just another move higher inside the channel. Here’s the chart zoomed in on recent price action:

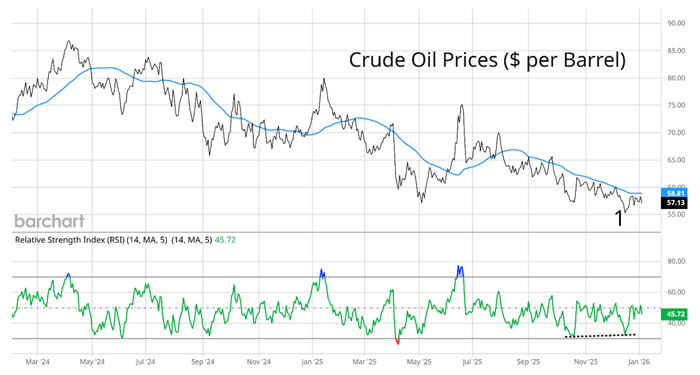

Oil prices found a recent bottom at “1” in mid-December. As I noted earlier, it’s time to pay attention when the price stops moving lower on bearish news.

The Relative Strength Index (RSI) in the bottom panel also made a positive divergence. The RSI measures underlying price momentum, and it did not make a lower low at “1.”

That hints at downside momentum fading, with oil prices rallying off that level. If oil can keep the upside going, the next key level to watch is the 50-day moving average (MA – blue line).

The 50-day MA has served as resistance on numerous occasions going back to last August, and it is being tested from below once again.

Oil prices are finally putting up a fight against bearish headlines. Clearing the 50-day MA is the next sign to watch for a major trend change in oil prices.

So traders looking for an opportunity should keep a keen eye on oil prices and the United States Oil Fund (USO) that tracks oil in the coming days…

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.