Everywhere you look, geopolitical headlines are dominating the market action.

Central banks are buying up gold. We’ve seen sudden bursts of stock market volatility around the trade war. And leading artificial intelligence companies like Nvidia (NVDA) are getting caught in tensions between the U.S and China.

These types of geopolitical catalysts are driving large price swings across the market… especially in one key commodity.

While most investors may fret over unpredictable market moves, they’re nothing new if you’ve ever traded oil before.

Crude oil production is concentrated among relatively few major suppliers. So oil prices have always been subject to whipsaws around supply disruptions.

But if you can break down a chart and understand price trends, you can capitalize on oil’s volatile price action.

It’s how I secured two double-digit gains for my followers in recent days…

I’ve traded oil throughout my over 40-year career because it can experience massive price swings in a short amount of time. That can provide ample trade setups.

And this year has been no different. Geopolitical forces have been working against oil for most of the year.

The trade war is clouding the outlook for demand, as global economic growth has been revised lower. That led the International Energy Agency to recently cut its outlook for oil demand growth.

At the same time, a key oil-producing group has been boosting production. The OPEC oil cartel has increased production by 2.7 million barrels per day this year, or about 2.5% of total demand.

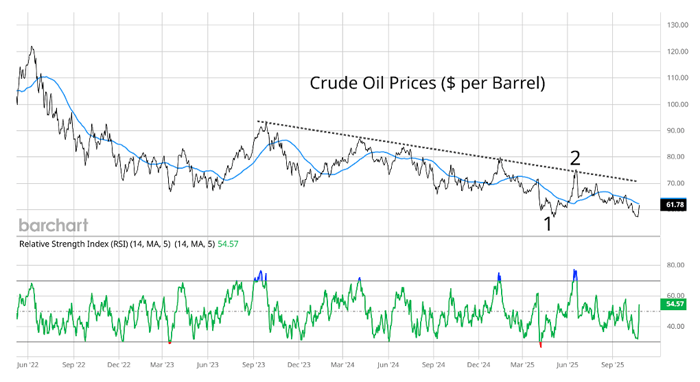

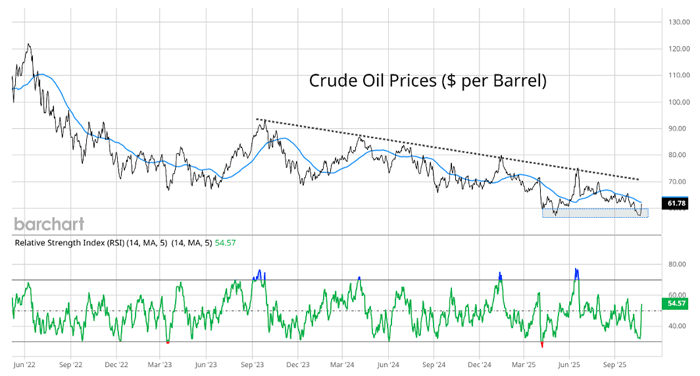

A combination of weakening demand and rising supply has kept oil in a bearish chart pattern, which you can see below.

Going back to late 2023, oil prices have been stuck in a downtrend with a series of lower highs (dashed trendline).

Oil prices fell as low as $57 per barrel in May at “1,” and then they rallied to test the downtrend line again at “2.”

From there, oil reversed lower and took out the 50-day moving average (MA – blue line) to the downside.

The break below support at the 50-day MA led to our first trading opportunity.

Subscribers to my One Ticker Trader advisory were alerted to buy puts on the United States Oil Fund (USO), which tracks oil prices, on August 13.

Puts gain in value when the underlying security price is dropping.

Yet it took longer than expected for the trade to play out. Our puts were nearing their October expiration date, so on October 10, we took a 19% loss on our existing position and then “rolled” into a new put position with more time. It’s never fun to take a loss, but as you’ll see, the winning trades that followed were more than able to make up for it.

The bearish action resumed, and a drop in oil prices sent USO lower in short order, which allowed us to close out our new USO put position for a 16.6% gain in just seven days.

Then, as oil prices dropped toward their lowest level of the year, a new opportunity presented itself…

The same day One Ticker Trader took profits on our USO puts, we turned around and opened a new USO call position. Call options gain in value when the underlying security is rising.

The pullback in oil prices tested a key support level… and created the setup that delivered our second trading opportunity. Take another look at the chart.

Oil prices fell back toward the $57 per barrel level, creating a bullish double-bottom chart pattern (shaded box).

Oil rallied from there after the Trump administration announced new sanctions on Russian oil, which could disrupt global supplies.

On October 23, we had the chance to take an 87.2% gain on our USO call options.

In less than a week, we made some handy profits from the volatility in oil prices in both directions.

That shows the value of staying nimble when markets get turbulent – and not locking in a bullish or bearish view.

By staying flexible and objective, you can position yourself for gains no matter which direction the market takes.

And if you’re interested in learning more about how One Ticker Trader works… and some additional commodity opportunities we’re tracking… I’d recommend checking out my recent video on that topic here.

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.