Note: If you missed Larry’s 12 Months to Retirement event last week, be sure you go here to catch it before it goes offline…

Larry reveals one of his most consistent income-producing strategies that pays out almost every day the market is open…

This strategy even helped him bring in $95 million in profits in one year in his hedge fund days.

And now, he’s sharing it with his members. If you want to hear more about it from Larry, just go here to watch the replay. But hurry, it won’t be available much longer…

It’s been a difficult year for the U.S. dollar.

The U.S. Dollar Index (DXY) measures the performance of the dollar against a basket of other major currencies like the euro, British pound, and Japanese yen.

At one point in the first half of this year, DXY was down more than 10%. Such a drastic move might be common for a meme stock in a single day.

But the world’s most important currency rarely moves that much.

In fact, that decline marked the worst start to a year for the dollar since 1973, when the dollar was permitted to float against other currencies.

But the dollar’s woes have been a boost for other areas of the market…

In fact, this year’s historically bad start for the U.S. dollar has been a boost for just about everything from stocks to Bitcoin and gold.

But now, that tailwind is showing signs of unraveling.

And just as DXY’s pullback helped push several assets to new heights, a dollar reversal could send prices lower.

Many market sectors have a negative correlation to the U.S. dollar, meaning that when the dollar is declining, other assets are rallying (and vice versa).

That negative correlation comes about for various reasons depending on the asset in question.

For stock prices, a weaker dollar can produce an earnings benefit.

For companies operating in international markets, a falling dollar makes money received in foreign currencies worth more in dollar terms. That can help increase sales and earnings.

Many commodities, including gold and silver, are priced and traded in U.S. dollars.

When the dollar is weakening against other currencies, that increases the purchasing power of non-U.S. buyers, as they can convert more of their local currency into dollars. That increases international demand for commodities.

And to the extent that a falling dollar reflects concerns over rising money supply, investors will often turn toward gold and Bitcoin as a store of value.

You can see how movements in the dollar can send ripple effects across the capital markets.

Looking at year-to-date returns, gold and gold miners have shown the largest negative correlation to the dollar.

Next up is silver, followed by Bitcoin. The Nasdaq-100 and the S&P 500 are seeing the negative correlation benefit returns this year as well.

But just as various corners of the market have received a dollar bump, a reversal in DXY could leave the rally exposed.

|

Tune in to Trading With Larry Live Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. |

The movement in the dollar has been a tailwind for stocks, precious metals, and Bitcoin since 2022’s bear market ended.

DXY peaked in September 2022 and has fallen by 13% since then.

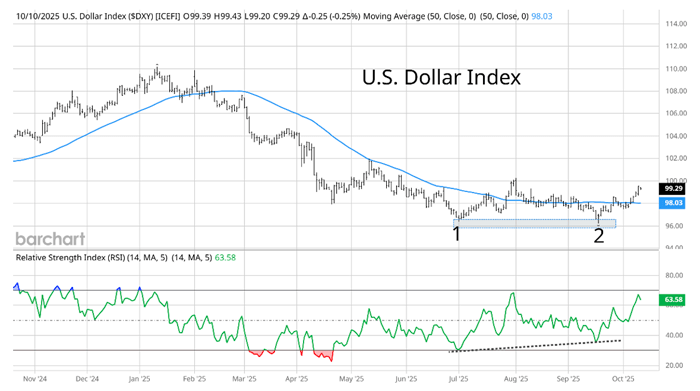

Those declines accelerated this year, but the dollar is showing signs of a major reversal underway. Take a look at the DXY chart…

DXY hit its lows for the year near the 96 level back in July at point 1. Following a rally attempt, DXY resumed the decline and tested the 96 level again at point 2.

But that test of the lows is looking like a double bottom (shaded area), while a positive divergence in the Relative Strength Index (RSI) hinted at the potential for a rally.

You can see the RSI made a higher low from point 1 to point 2, which indicates that downside momentum was fading.

From there, the dollar has reversed higher and is crossing back above the 50-day moving average (blue line).

The next crucial level to watch is 100. DXY was rejected off that level on the last rally attempt, and DXY is approaching that resistance area once again.

We already saw large single-day reversals in gold, silver, and Bitcoin late last week. If DXY breaks above 100, expect to see more pressure on the everything rally.

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

|

Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.