Larry’s Note: I’m preparing for my “Federal Reserve decision” trade as we speak. As soon as the right setup appears, I’ll issue my recommendation.

That could be your last chance to act.

Imagine placing a trade this today… and pocketing hundreds or thousands of dollars before the week is out. While I can’t guarantee anything, that’s the kind of opportunity in front of us now.

When a huge Fed meeting and another big Wall Street event align, it creates the opportunity for outsized gains.

Click here to get the details before it’s too late.

Drama will be on full display this week. President Trump has demanded that Federal Reserve Chair Jerome Powell slash interest rates.

He may finally get his wish.

The central bank will conclude its latest rate-setting meeting on Wednesday. Current odds point to a 100% chance that the Fed will cut interest rates.

But it’s not just rate cuts drawing attention.

Speculation is running high about who will succeed Powell as chairman when his term ends next year.

Plus, Trump is trying to remove another Fed governor for the first time in history. A judge blocked that action, though, so matters remain in limbo ahead of this week’s meeting.

As you can see, the Fed faces a lot of distractions.

But at the same time, the central bank is staring at one of the most daunting economic challenges in over 40 years.

No matter what the Fed does with interest rates, things could get worse.

But all the same, that could spell trading opportunities if you have the right approach…

The Fed’s worst-case nightmare is quickly becoming a reality.

Congress tasks the central bank with maintaining full employment along with price stability (i.e., low inflation).

Any problems are usually a straightforward tradeoff…

After all, inflation is often high when unemployment is low. That points to a strong economy. Yet inflation is usually low and falling when unemployment is high or when the economy is weak.

The Fed adjusts interest rates to bring things back into balance. High rates should slow the economy and lower inflation. Lowering rates should have the opposite effect.

But the dreaded “stagflation” scenario is different.

With stagflation, both mandates get out of whack… with rising unemployment alongside high inflation.

That’s increasingly what the current situation looks like. As I showed you recently, the labor market is quickly deteriorating.

At the same time, the most recent Consumer Price Index (CPI) shows that consumer inflation is running higher than desired.

Core inflation that excludes food and energy prices was 3.1% in August. It’s been around that level for over a year. The Fed’s inflation target is 2.0%.

So the Fed has a tough decision to make this week. Lowering rates as widely expected could help the labor market but make inflation worse. Keeping rates high might lower inflation but also cause even more pain in the labor market.

The Fed faces a no-win scenario.

And while the situation seems dire, that could end up being good news for active traders…

|

Tune in to Trading With Larry Live Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. |

I don’t wish economic hardship on anyone. But the potential for volatility does get me excited.

The 1970s were the last time the U.S. went through a prolonged period marked by high unemployment and inflation.

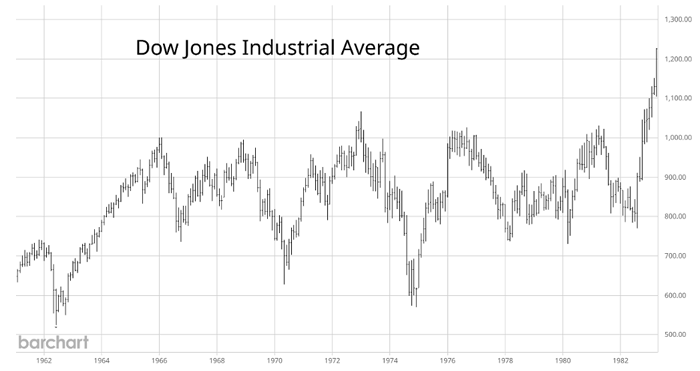

Investors like to forget about the period altogether. The Dow Jones Industrial Average went nowhere from 1966 through 1982. The 1970s were a “lost decade,” as you can see in the monthly chart below covering the period.

But the decade was only lost if you were a buy-and-hold investor. Traders saw the type of environment that most can only dream of.

The Dow saw four rallies of 30% or more during that stretch. Two of those bull runs topped 70% gains.

The index also experienced three bear markets, with the worst instance dropping 46%.

Just like we saw in the 1970s, stagflation could take the stock market on another roller coaster ride. The stock market will be torn between interest rates, inflation, and the labor market.

But it doesn’t have to all be bad news. Anyone who is prepared to trade each up and down swing could make out handsomely in the upcoming period.

I’ve made a living trading through some of the most volatile situations investors have ever seen.

With the right approach, you can thrive if we enter a new period of stagflation. So if you aren’t already tuning in to my Trading With Larry Live podcast in the mornings, consider checking it out.

I’ll do my best to guide you through whatever lies ahead.

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

|

Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.