Larry’s Note: We’re facing insane challenges right now:

Massive government debt and fiscal recklessness…

Interest rate uncertainty…

Geopolitical instability…

Not to mention, loss of confidence in the U.S. dollar across the globe.

But those challenges just make the strategies I offer more important than ever. In fact, there’s one particular strategy that is perfectly suited to profit from all that I just mentioned.

It takes advantage of trillions of dollars moving each day in one specific marketplace. Yet many people completely miss out on the opportunities in this space.

I don’t want you to be one of them. If you’d like to learn more, then simply go right here for a quick breakdown.

It’s easy to be lulled into a sense of complacency when the stock market makes steady gains.

The S&P 500 has rallied 27% from the early April lows.

The Nasdaq-100 has seen 60 consecutive trading sessions above its 20-day moving average. That streak is closing on the record set back in 1999 during the internet bubble.

But just when everyone thinks that trading is easy… you should be on the lookout for a jump in volatility.

I’ve been trading for over 40 years. I’ve seen everything from the 1987 Black Monday crash to the 2008 global financial meltdown and the 2020 Covid crash.

Volatility can come out of nowhere. And when everyone is blissfully riding the wave, history says you should be cautious.

Here’s why you need to stay prepared for a return of volatility in the months ahead…

The CBOE Volatility Index (VIX) is a popular tool for traders. It reports expected volatility in the S&P 500.

That’s why some call it Wall Street’s “fear gauge.” The VIX usually jumps higher when the S&P 500 pulls back.

That’s because daily price movements pick up when the stock market is selling off. Conversely, the VIX tends to be the lowest when stock prices are steadily grinding higher – like now.

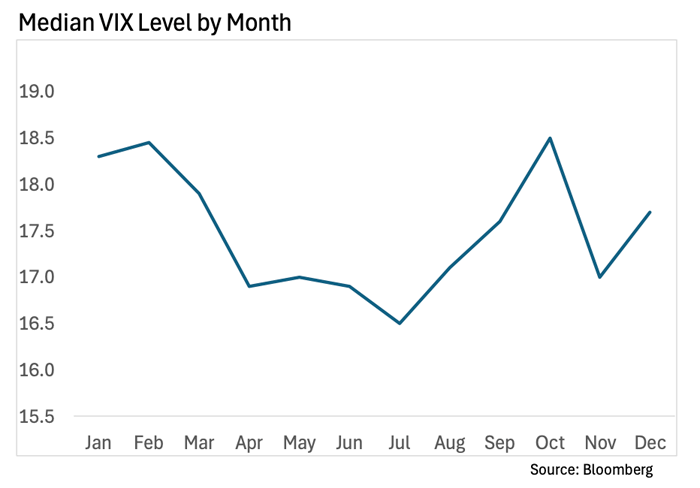

And just like the S&P 500, the VIX experiences seasonal patterns.

Right now, the S&P is in one of its best months in terms of calendar seasonality. Since 1928, July has been the best month for average returns.

The VIX reflects that bullish trend as well. The VIX tends to fall to its lowest levels of the year in July, which reflects the positive trend in the stock market.

And right on cue, the VIX is hovering near its lowest levels of the year. Take a look at the VIX median values by month below:

But now’s the time when that trend often reverses. After bottoming out in July, the VIX historically starts to jump over the next three months.

And there’s one big catalyst unfolding in the next couple of weeks that could spark a change in the VIX.

|

Tune in to Trading With Larry Live Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. |

Stocks are priced for perfection.

I showed you earlier this week how the 10 largest stocks in the S&P 500 are trading at valuations that eclipse even the internet bubble.

That means any hiccup on the earnings outlook could lead investors to quickly start second-guessing the current rally.

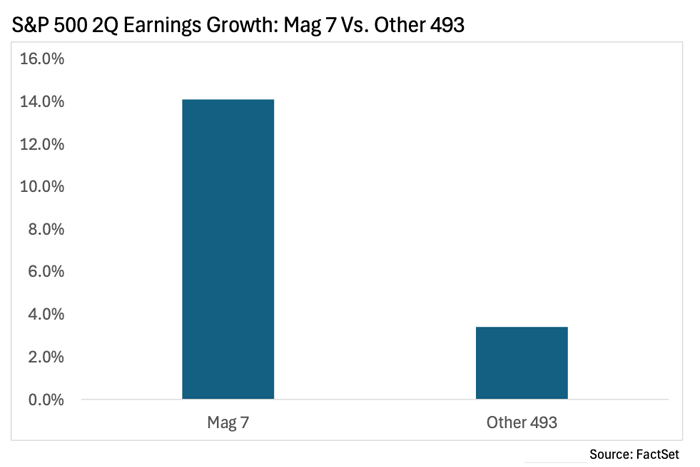

So the earnings season that just got underway is all the more important. After all, the “Magnificent 7” stocks are expected to drive the bulk of earnings growth compared to the remaining 493 companies.

Take a look at the chart below:

You can see that second-quarter earnings growth for the Mag 7 is expected at 14.1%. Meanwhile, the rest of the S&P is only expected to grow earnings by 3.4%.

The Mag 7 continues to do the heavy lifting… whether it’s helping drive the market to new highs or supporting the corporate profit outlook.

With so much depending on just a handful of companies, though, the market is susceptible to any disappointments.

That makes the VIX worth watching closely.

Any earnings disappointment among the Mag 7 could ensure that the VIX follows its seasonal roadmap right on schedule.

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

|

Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.