|

Larry’s note: Welcome to Trading with Larry Benedict, the brand new free daily eletter, designed and written to help you make sense of today’s markets. I’m glad you can join us. My name is Larry Benedict. I’ve been trading the markets for over 30 years. I got my start in 1984, working in the Chicago Board Options Exchange. From there, I moved on to manage my own $800 million hedge fund, where I had 20 profitable years in a row. But these days, rather than just trading for billionaires, I spend a large part of my time helping regular investors make money from the markets. My goal with these essays is to give you insight on the most interesting areas of the market for traders right now. Let’s get right into it… |

Housing prices are at record highs.

The property market is all over the news.

Many homes listed for sale receive multiple offers a day… sometimes even millions of dollars over asking price.

So, with prices soaring and supply dwindling, who’s responsible?

Well, it’s not just eager homebuyers driving the real estate market higher…

Huge institutional investors have been buying homes by the thousands.

In just one deal in June, Blackstone paid $6 billion to acquire over 17,000 homes.

By any measure, real estate is a sector that is running hot. And not just in the U.S. either.

A glut of cheap money, brought upon by ultra-low interest rates, has pushed property prices up all over the globe.

One way I keep tabs on the global property market is via the SPDR Dow Jones Global Real Estate ETF (RWO). Although it’s a global ETF, around 62% of RWO’s assets are in the U.S.

To be eligible for inclusion in RWO, companies must derive at least 75% of their revenue from owning and/or operating real estate assets.

Meaning, any company in this ETF is highly reliant on the health of the real estate market.

Quite simply, if these properties are performing well, so too will RWO.

Let’s check out its daily price chart…

The rising trend shows just how healthy RWO has been. From March of last year, RWO has rallied a whopping 85%.

However, not all of the news around real estate is positive.

Just last week, Reuters reported that over 15 million people across 6.5 million U.S. households were behind in their rent. All up, it estimates renters are more than $20 billion in arrears.

Sadly, it’s a similar tale in Europe.

Last month, Reuters quoted figures from Housing Europe that estimates 10 million European households are in danger of eviction. They simply can’t afford to pay the rent.

That’s why when I look at RWO, I want to gain a broader perspective than just its recent price action.

To do that, we need to go back further in time.

Below is another chart of RWO…

But this time, we’ll take a look at a weekly price chart.

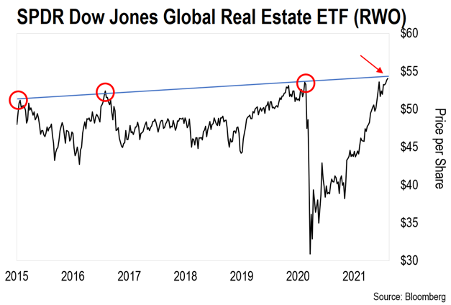

The data on the chart goes back to 2015. The blue line on the chart shows its resistance level. The red circles indicate each time RWO hit resistance.

As you can see, each time RWO touched the blue line, the price subsequently fell. The first and second time (in 2015 and 2016), RWO fell around 15%.

The biggest fall came in March 2020. Over just six weeks, RWO dropped around 45%.

After rallying strongly these past 17 months, RWO is now closing in quickly on that blue line (red arrow on the chart).

Whenever a stock gets near its historic resistance level, I watch it like a hawk. History tells me that it often brings in new buyers or sellers.

In this case, the resistance has previously brought in a wave of heavy selling.

Right now, it’s still too early to tell. We don’t yet know if the price will bounce lower off this level.

However, I think the price action looks particularly promising. We know that if RWO were to retrace its previous moves, there could be a significant move lower in the cards.

So, keep an eye on RWO’s resistance level. If it bounces off resistance and starts to move lower, a potential short trade could be quite profitable.

Regards,

Larry Benedict

Editor, Trading With Larry Benedict

P.S. We’re excited to hear what you think of your new eletter, Trading With Larry Benedict. Let us know at [email protected].

Reader Mailbag

I’m excited to hear from so many of you who’ve been enjoying my new Trading With Larry Benedict e-letter…

Just started to receive your information. It is very basic, but that is good. There should always be constant reminders of the basics. Very impressed with your newsletter.

– Aaron W.

Hi, I was moved by Larry’s email, what he says I 100% agree with.

I have heard a lot about options, but there always seems to be strings attached, which puts me off. Can you tell me more about learning options please? Regards.

– Kevin A.

Hi folks! I’m brand new to trading but an old hand at losing money! Plenty of ways to do that! And that is why the notes on earning your risk struck a chord. I’m following along!

– Tim M.

It’s so refreshing to read an informative letter that isn’t a 30-minute waste of my time that turns out to be an infomercial. I’m loving it!

– Michael M.

I always find your advice very handy as a new trader. It helps me to slowly sharpen my talents, thanks.

– Peter B.

OMG! That is badass! You totally have the best information that I have seen in all the newsletters that I have read in the past year.

I have been doing this for only a year and you are making my eyes wide-open and my brain work overtime. Please keep it coming. Thank you so much.

– Kevin H.

Larry, I just wanted to thank you for your emails about trading. I appreciate them.

– Jim F.

Thank you, Larry. For the first time, options start to make some sense.

Five years ago, I joined an investment circle run by a couple of gurus, who said they cannot go wrong. They then proceeded to give me advice, which promptly lost everything I had.

So, needless to say, I am very cautious about options. But I like reading your down-to-earth style.

– Elizabeth M.