I don’t pay much attention to valuations when trading.

As a professional trader, I focus on taking advantage of short-term fluctuations in the stock market. A company’s price-to-earnings ratio doesn’t really matter in that context.

That’s not just my 40+ years of trading experience speaking. The research shows that over short-term time frames, there isn’t a correlation between valuation measures and price movements.

That’s not to say I don’t care about valuations, though… especially when you look at the broader stock market over the long term.

Valuations can reveal what type of trading environment is lurking ahead. And right now, they’re showing us a clear warning.

So if you’re a buy-and-hold investor, you need to sit up and pay attention… because now could be among the worst times ever to buy into the market.

Here’s what you need to know… and what you can do to prevent a financial disaster.

Valuations can make or break your portfolio over the long term. That’s especially the case if you’re a buy-and-hold investor. So let me explain why now could be one of the worst times in history to let your portfolio ride.

When you put your money to work in the stock market, valuations are one of the most important factors driving your long-term return.

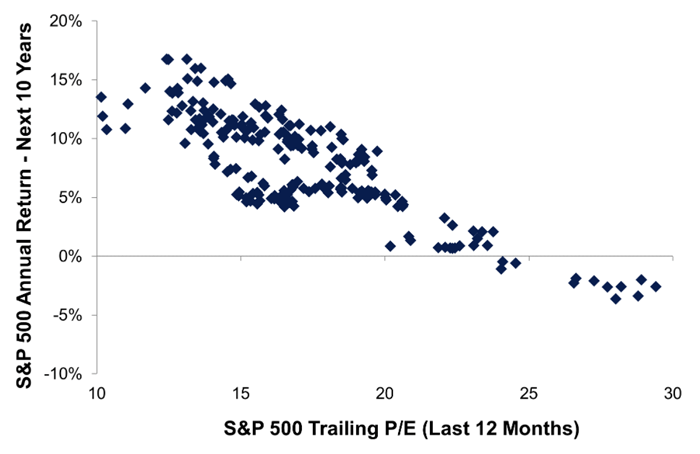

Take a look at the chart below:

Source: LPL Financial

The chart plots the S&P 500’s price-to-earnings (P/E) ratio on the horizontal axis and the subsequent 10-year return on the vertical axis.

Notice the relationship between the level of the P/E ratio and the return seen over the next 10 years. The higher the P/E, the worse the returns.

The most extreme valuations see subsequent returns clustered in negative territory.

After the bull run we’ve been on for the past few years, imagine getting a negative return on average every year for the next 10 years.

But that’s exactly what the chart shows when you buy at these valuation levels. The S&P 500’s trailing P/E ratio currently stands at 27.

So if you’re currently saving for retirement, your kids’ college funds, or anything else where you’re committing your capital over the long term, you need to rethink your investment strategy.

In fact, you need an entirely new playbook for the volatility looming ahead.

I know what it takes to navigate a volatile market backdrop, including outright panics and economic depressions.

I was a young trader when Black Monday hit in 1987. Since then, I’ve traded through the dot-com bubble bursting in the early 2000s, the Great Financial Crisis in 2008, and the COVID crash.

I also maintained a streak of 20 consecutive profitable years during my hedge fund days, which included some of the most volatile environments investors have ever seen.

I didn’t get those results with “buy and hope” investing. I stayed nimble and adapted to the market while deploying trading strategies that I’ve honed over a 40+ year career.

Now I’m sharing those approaches with members of my trading services. And we’ve seen excellent success. As just one example, the last time we had a bear market in 2022, every single one of my products running at that time delivered a positive return for my followers.

With valuations running near their most extreme levels in history, I believe we’re facing one of the most challenging markets of our lifetimes ahead.

But volatility can be turned into a profit opportunity with the right trading strategy.

That’s why, last night, I sat down to share “Benedict Capital.” I’ve referred to this as my “hedge fund for regular folks.” And I believe it could put you on the path to an impressive nest egg, no matter what the market does.

If you weren’t able to join me last night, then please check out the replay here to get all the details.

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.