When markets rallied from 2020 through 2021, traders focused so hard on the uptrend that many only considered going long.

Yet with high inflation and rising interest rates now tipping the market on its head, those same traders have completely flipped their view.

Now, many are so negative that they only consider going short.

However, one-dimensional thinking is a real mistake for traders. Because most of the time, markets swing in between these two extremes.

While they might break out in one direction, they won’t go that way forever. It’s like a rubber band stretched too far. They’ll eventually revert to their mean.

And even in strongly trending markets, there are lots of countertrends along the way.

So, if you only view the market from one angle – bullish or bearish – you’re going to miss out on many trading opportunities.

Trends and Countertrends

When most folks get started with charts, the first thing they normally learn is how to identify a trend.

They look for a series of ascending or descending price points that they can join to form a straight line.

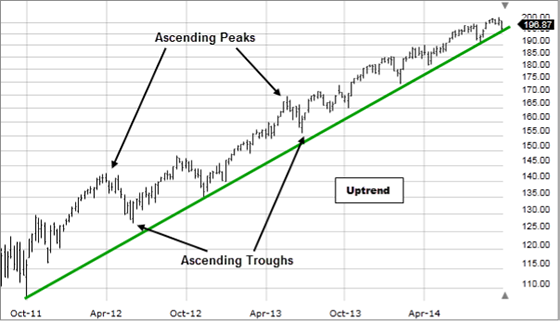

For example, take a look at this trends chart…

Spotting Basic Trends

Source: Fidelity

And once they spot these trends, investors think they’ll increase their odds of success by trading with – not against – the underlying trend.

Now, don’t get me wrong. Learning to identify trends (or lack thereof) is crucial when it comes to reading charts.

However, stocks (and the market) don’t move in straight lines. Even if they trend strongly, they’ll eventually snap back the other way.

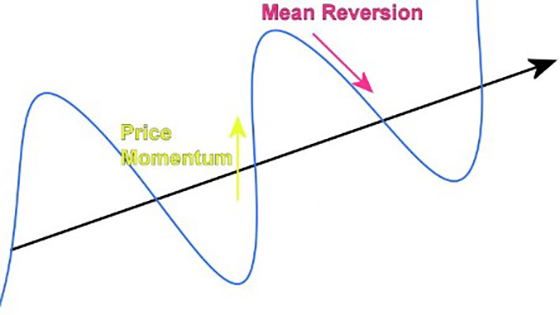

Take a look at this chart to see what I mean…

Source: Tradinformed

Many trading opportunities arise when a trend reaches mean reversion. This is simply a by-product of market dynamics as buyers and sellers constantly rebalance.

For example, if everyone is long on a stock and its price keeps going higher, eventually someone is going to want to take their profits off the table.

Once one trader does it, others will start to follow for fear of missing out on profits.

As that selling momentum increases, it’ll eventually outweigh the buyers. That, in turn, sends the stock price lower.

Even in strongly trending markets, these moves against the major trend happen regularly. And they can provide good profits if you’re ready to act quickly.

Putting Profit in Your Pocket

From a trading perspective, these countertrend moves offer many opportunities.

In fact, they’re a basic characteristic of market cycles that I’ve used throughout my trading career on Wall Street.

When the major indices got smashed in the Great Recession, my hedge fund was ready… and we profited handsomely from the inevitable bounce.

The good thing is that these rebounds – or reversions to the mean – happen no matter what the market is doing because markets overshoot in both directions.

They also work in whatever timeframe you’re trading… whether each tick on your screen represents a minute, an hour, or a week.

It’s a simple pattern – a move followed by a countermove – that constantly repeats. And this enables nimble traders to capture short, sharp moves that go against the major trend.

In fact, followers of my S&P Trader service experienced this just last week.

Starting September 6, the S&P 500 Index (SPX) had bounced high, rising roughly 5% in a week. As such, it was due for a return to the mean – especially with the release of the latest inflation numbers.

So on Monday morning, we opened an options trade expecting the market to fall. The next day, the SPX dropped 4%… sending our options trade up as much as 130%.

Of course, not every trade we make will be that big. This trade benefited from especially high volatility from the lead-up to a Quad Witching. (A Quadruple Witching is a market event in which several derivatives contracts expire on the same day.)

Yet this example shows the power that mean reversions can have.

If you add up all these little profits over a year, you’ll be amazed at how quickly your account will snowball.

But if you only stay fixed on the market’s direction, you’re going to miss out on a lot of this action.

Instead, you should park your biases at home and view the market simply in terms of repeatable patterns. Then you’ll be ready to jump onto more prospective moves.

And that’ll put more dollars in your pocket.

Regards,

Larry Benedict

Editor, Trading With Larry Benedict

Reader Mailbag

In today’s mailbag, One Ticker Trader members share their experience from Larry’s recent trade recommendation…

This was my first trade on your One Ticker Trader program. I got out with a 6.93% gain on three contracts.

– Isidoro F.

Hi Larry. Since I was working, I couldn’t enter the $275 put until Monday. I paid $2.34 and sold on Tuesday at $5.03. Nearly 115% in one day! Thank you.

– James S.

I wasn’t able to get into the trade at the start. I did enter it at $2.28 and sold out at $5.05. Up $1,108. The triple witching trade is up $5,887. A great day plus $6,807. Thanks, Larry.

– Gene S.

Thank you as always, for your thoughtful comments. We look forward to reading them every day. Keep them coming at [email protected].