|

Larry’s note: Welcome to Trading with Larry Benedict, the brand new free daily eletter, designed and written to help you make sense of today’s markets. I’m glad you can join us. My name is Larry Benedict. I’ve been trading the markets for over 30 years. I got my start in 1984, working in the Chicago Board Options Exchange. From there, I moved on to manage my own $800 million hedge fund, where I had 20 profitable years in a row. But these days, rather than just trading for billionaires, I spend a large part of my time helping regular investors make money from the markets. My goal with these essays is to give you insight on the most interesting areas of the market for traders right now. Let’s get right into it… |

For nearly a decade, it seemed as though the markets had forgotten all about inflation.

At one point, there were talks of getting rid of the inflation target altogether.

But nowadays it seems like it’s impossible to forget about inflation, or the damage it can cause to the markets.

Once inflation hits, it often takes a series of interest rate hikes to get inflation back in check – if at all.

That can lead to some serious selling in the market, sending stocks much lower. So, the spike in inflation this year caught my attention.

Because of the damage inflation can cause, I like to keep a close eye on it.

But instead of waiting for the monthly Consumer Price Index (CPI) report, I like to get ahead of the market by watching the infrastructure sector.

Infrastructure is less vulnerable to inflation (and higher interest rates) than other sectors. That simply comes down to how infrastructure deals are structured.

For example, toll road operators and airports typically have lengthy contracts that allow for CPI adjustments. So, they can increase their charges as inflation rises.

This allows infrastructure to act as a hedge against inflation.

One ETF that represents this sector is the SPDR S&P Global Infrastructure ETF (GII). GII owns 75 infrastructure assets around the globe.

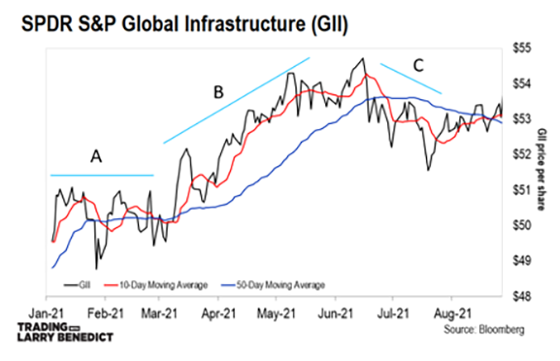

Let’s look at the GII chart…

The chart shows three clear and distinct parts since late last year.

The first (‘A’), from December 2020 to March 2021, GII traded sideways. At this point, inflation wasn’t on anyone’s radar.

Then, when inflation started to jump from March onwards, GII began to rally (‘B’).

This usually happens because professional money managers don’t have the luxury of sitting out the market. Unlike private investors, they can’t be “all in”, or “all out.”

Instead, they rotate out of one sector and into another. The last thing they want is to be overweight in growth stocks when “growth” disappears into thin air.

That’s why with higher inflation – meaning potentially higher interest rates – we saw professional money rolling into infrastructure stocks like GII.

However, with all the talk of inflation being “transitory,” the heat came out of GII. Enough to shake buyers out of the market. Then, we saw GII fall around 7% from mid-June to mid-July (‘C’).

Now, though, GII has once again been grinding higher.

On the chart are two moving averages (MA). The shorter-term 10-day MA (red line) recently crossed above the longer-term 50-day MA (blue line).

That’s usually a bullish sign… but perhaps it’s still too early to consider a trade.

As we get closer to the next CPI release in mid-September – you can be sure I’ll be watching GII like a hawk. That’s because there are two potential trade setups on the table…

If inflation does turn out to be “transitory,” then GII and other infrastructure assets could be heading for a fall – creating a potential short trade.

However, if inflation continues to jump higher, you can expect big money to again rotate out of other assets, and park their money in assets like GII.

In that case, a long trade could be in the cards.

Either way, you can be sure of one thing… inflation is now very much back on professional investors’ minds and it’s creating setups in both directions for us to profit.

I’m going to keep an eye on this one.

Regards,

Larry Benedict

Editor, Trading With Larry Benedict

P.S. We’re excited to hear what you think of your new eletter, Trading With Larry Benedict. Let us know at [email protected].