Managing Editor’s Note: According to technologist Jeff Brown, we are closing in on the next major leap in artificial intelligence… and with it, a surge in productivity is going to trigger an economic “big bang” on a scale we’ve never seen before.

He’s confident that a new age of AI-powered prosperity is just around the corner. And tomorrow at 8 p.m. ET, Jeff’s revealing what this new age will look like… and how you can position yourself to profit before it begins.

If you haven’t signed up to attend his event yet, be sure to do so here with one click.

Currency trading, also referred to as foreign exchange (forex), is the biggest market in the world. Trillions of dollars change hands every day.

It also has little to no correlation with stocks. So you can profit from forex trading no matter how stocks are performing.

That’s why I’ve been trading forex for around 40 years. During that time, I estimate that I’ve traded a trillion dollars in combined value in forex trades.

The key to understanding forex is that you are essentially backing the strength of one currency against another. So, for example, if you thought the euro (EUR) was going to strengthen compared to the U.S. dollar (USD), you’d buy the EUR/USD pair.

That’s what we did in the trade we’re going to look at today…

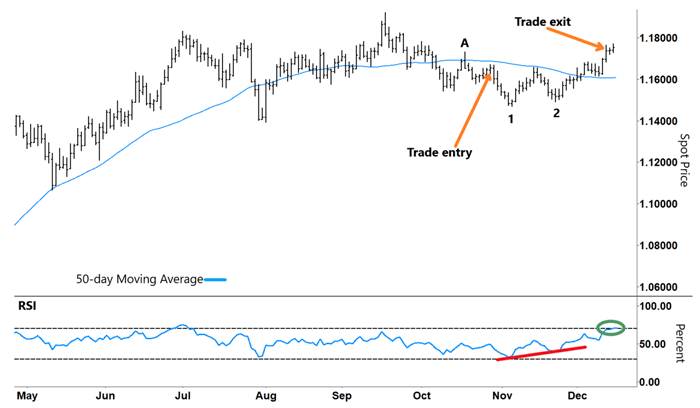

After retracing from a short-term peak (“A”), the EUR/USD pair made a higher low on October 22. From there, the pair steadily built upward momentum.

EUR/USD Spot Price

Source: eSignal

The Relative Strength Index (RSI) began rising and pushing up against resistance (50% level). A break above that is typically a bullish sign. The pair was also on the verge of breaking up through the 50-day moving average (MA, upper blue line) – another bullish signal.

And beyond the chart, macroeconomic factors were playing an important role…

Chief among them were the different interest rate expectations between the respective countries/zones. While the European Central Bank’s rate-cutting cycle was ending, the Federal Reserve had further to go. That was bearish for the USD.

So we bought the EUR/USD on October 28 in anticipation of the euro strengthening against the USD.

But no sooner had we entered the trade than things went against us…

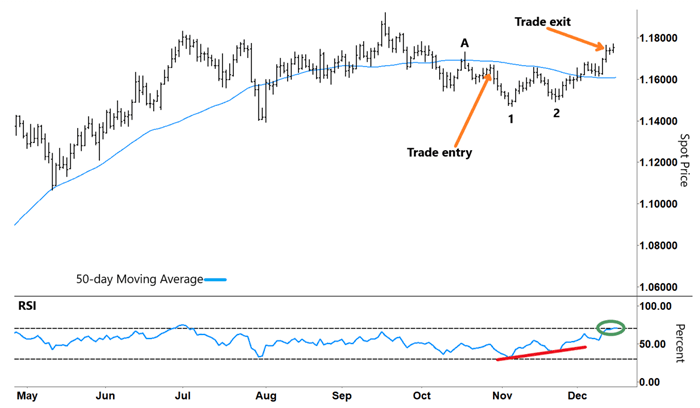

Take another look:

EUR/USD Spot Price

Source: eSignal

Momentum rolled over. The pair steadily fell back toward our stop loss level (set at 200 pips below our entry price).

Then the RSI formed a “V” and rallied from oversold territory (lower gray dashed line). That corresponded with the pair locking in a low at “1.”

The RSI reversed around resistance again. Then it made a higher low (red line). Higher lows in the RSI often correlate to higher lows in the currency pair (as we saw at “2”). This hinted that an uptrend was emerging.

That uptrend gathered strength along with two decisive signals…

With the RSI heading into overbought territory (green circle), we decided to take our profits off the table. We exited the trade with a 115 pip gain. That equates to $1,150 for anyone trading a standard lot position size.

As you can see, this trade didn’t initially go our way. But bullish technical signals provided the confidence to stay the course.

That tidy profit is just one example of how my subscribers have profited from trading currencies. And I’m looking forward to more trading opportunities in 2026.

Happy Trading,

Larry Benedict

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.