|

Larry’s note: Welcome to Trading with Larry Benedict, the brand new free daily eletter, designed and written to help you make sense of today’s markets. I’m glad you can join us. My name is Larry Benedict. I’ve been trading the markets for over 30 years. I got my start in 1984, working in the Chicago Board Options Exchange. From there, I moved on to manage my own $800 million hedge fund, where I had 20 profitable years in a row. But these days, rather than just trading for billionaires, I spend a large part of my time helping regular investors make money from the markets. My goal with these essays is to give you insight on the most interesting areas of the market for traders right now. Let’s get right into it… |

Without a doubt, one of the biggest keys to my success has been finding and trading trends.

Trends can let you know where a stock is headed next, when something isn’t right, and even when to buy and sell (for more on that, read yesterday’s essay here).

But, there are a lot of stocks to choose from. And individual companies can be more prone to unwanted surprises.

On the other hand, a big index like the S&P 500 is so large that it takes a lot to move it. It is made up of 500 of the largest publicly traded companies, after all.

Because of its sheer size, it’s a good indicator of what the overall market is doing.

That’s why it’s my favorite market to trade.

It’s pure.

When trading individual stocks, things are much less clear. There’s always something you won’t know about. Perhaps it’s an earnings downgrade, or a big seller getting out.

My point is, any manner of bad news can send a stock plummeting.

But by trading the S&P 500, I don’t have to worry about all that. My only concern is finding out what direction the market is heading.

If the market goes up, I can make money trading long. And if the market goes down, I can make money going short.

To me, it doesn’t get any purer than that.

Plus, by trading the same product day in and day out, you get much better at predicting its next move. And that can help you become a more profitable trader.

When a market as large as the S&P 500 trends, there’s big money to be had. What we’ve seen over the last 15 months has been a perfect example of this.

If you check out the chart below, you can see what I mean…

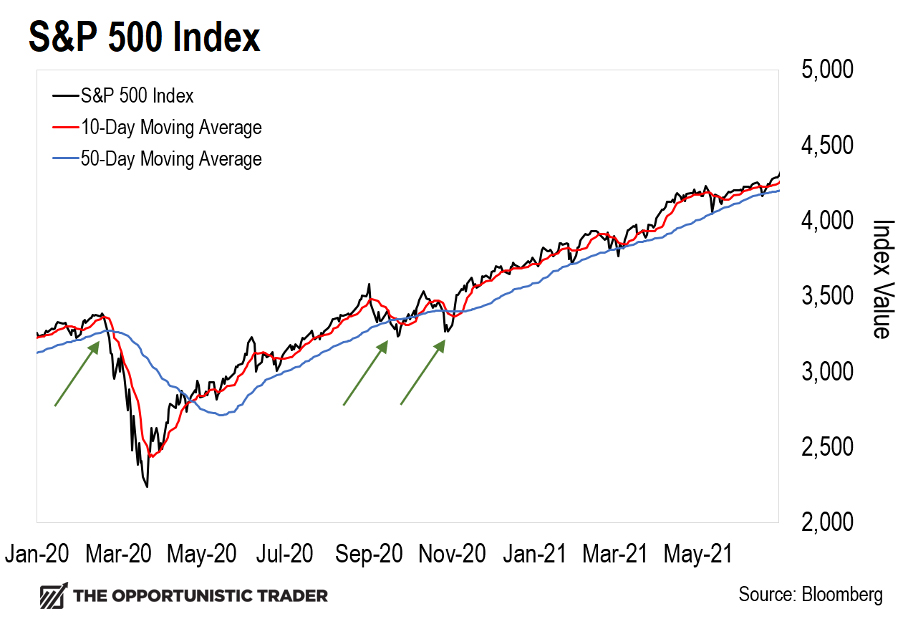

The chart shows two distinct trends.

The first is the sharp fall through March of last year, when the coronavirus ripped the rug out from under the global markets.

That’s demonstrated by the first green arrow, which shows where the red 10-day moving average (MA) line crossed below the blue 50-day MA line.

The second is the uptrend since grinding off of that March low. That’s when the red line crossed over the blue line, starting near the beginning of May 2020.

Apart from a couple of small retracements (green arrows) last September and into November, the red line has stayed above the blue line. Meaning, the uptrend has remained intact, and the S&P 500 has continued to move higher.

As the chart shows, the S&P 500 has doubled since the March low in 2020.

There’s no doubting the profitability of these powerful uptrends. With the right timing, you can really set yourself up for life.

These mega-trends can be life changing. But trends don’t last forever.

So, when you’re first starting out, it’s good to stick to a handful of stocks or indices. But once you’re familiar with them, you’ll begin to notice their relationship with other assets. Some things in the market will always be related, like gold and silver, for example.

This is the third thing that I look for in the markets – correlations.

Yesterday, we went over mean reversion. Today, we went over the importance of trends.

Tomorrow, I’ll be sharing how you can spot the relationships between stocks, indices, bonds, or commodities… and how you can use that to your advantage.

Knowing how key assets affect each other can set you up for big profits.

Stay tuned for tomorrow’s essay…

Regards,

Larry Benedict

Editor, Trading with Larry Benedict

P.S. We’re excited to hear what you think of your new eletter, Trading With Larry Benedict. Let us know at [email protected].