Larry’s Note: On Thursday, January 15, at 8 p.m. ET, I’m holding a special event called Get Rich Slow. And if you’re looking to capitalize on one of the only AI developments that is actually profiting right now, you need to be there.

Wall Street is making money hand over fist thanks to its increasing use of AI. Trading revenue just hit an all-time high of over $18 billion a quarter. That’s more than double what it was just three years ago. It’s a huge new source of income for Wall Street.

And I’ve discovered how to tap into it to collect short-term, double-digit gains. I’ll share exactly how on Thursday.

So if you’d like to get all the details, please plan to join me then. You can RSVP with one click right here.

The S&P 500 is pushing all-time highs again. S&P futures recently traded above the 7000 level for the first time.

On the surface, it’s easy to think that the bull run is back on in 2026. All you have to do is buy the Magnificent 7 and hold on for the ride.

But look a little deeper…

While the S&P 500 and Dow Jones are taking new ground, the Nasdaq has become a laggard. That reflects the rotation out of Big Tech into “old-style” industrial stocks.

If you hold on to tech stocks right until the end, you could suffer serious losses if we see a market downturn.

But if you can’t bring yourself to sell your holdings, consider protecting your profits at least.

Today, I want to show you how with a simple options strategy…

The strategy I’m referring to is a “collar” (or “protective collar”). It’s a two-pronged strategy:

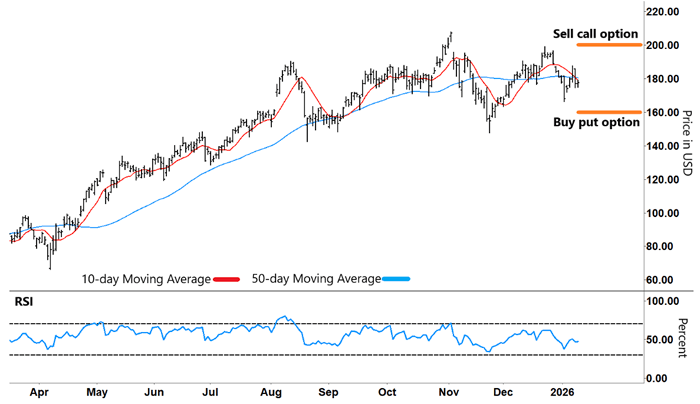

To see how the strategy works, let’s use Palantir Technologies (PLTR) as an example. And please note that this is an example, not a trade recommendation…

With PLTR trading around $180, you decide to protect yourself from a potential fall.

You buy a put option with a $160 strike price for a cost of $5.50 (leg number 1). You can offload your PLTR shares at $160 per share at any time until the option’s expiration – no matter how far PLTR falls. An option contract is for 100 shares, so one contract would cost $550 ($5.50 × 100).

Note that the closer the option strike price is to the current share price and/or the further out its expiration date, the higher that cost will be.

Palantir Technologies (PLTR)

Source: e-Signal

To help offset the cost of buying the put option, you sell a call option with a strike of $200 (leg number 2). You use the same expiration dates for both your put and call options and place both trades simultaneously.

For selling that $200 call option, let’s say you receive $5.30 (or $530) per contract. So the cost of buying the put option (your insurance) is almost entirely offset by the premium received from selling the call option. In this example, that amounts to just 20 cents (or $20 per contract).

The important thing to understand is that selling the call option comes with obligations…

If PLTR keeps rallying, you’re locked into selling your PLTR shares at $200 per share until the option expires. (Of course, you could buy the call option back and roll it up to a higher strike option like $230 if you want to keep your shares.)

However, if PLTR were to fall heavily to $100, for example, you can offload your shares at $160 per share right up until the option’s expiration.

Like many strategies, a collar is a trade-off.

By buying the put option, you have insurance to protect yourself against a large fall.

By selling the call option, you can fund the cost of that put option – with the risk of missing out on potential profits if the stock rallies and your call option is exercised.

But when you’re concerned about preserving the value of your stock gains, this can be an excellent way to protect yourself from a market plunge.

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

P.S. While a collar is a handy strategy to protect your profits, it’s just one of a myriad of option strategies that I use.

Over my 40-plus years of trading, I’ve used other option strategies to systematically pull double-digit profits out of the markets in quick time. And this Thursday (January 15) at 8 p.m. E.T., I’m going to show you how.

All you have to do is RSVP here with one click to my Get Rich Slow event. You might just find it’s the best decision you’ll make this year!

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.