Managing Editor’s Note: Tomorrow at 8 p.m. ET, our colleague Jeff Brown is sharing the details on what he believes is the fastest way to build wealth in America today…

It has all to do with a strange phenomenon triggering quick, explosive moves in a very small group – less than 1% – of stocks. And these gains can be lightning-quick… So fast that by the time most folks have caught on, it’s usually too late to get in.

That’s why Jeff’s developed an AI to help spot these phenomena… weeks before they happen.

Make sure you go here to automatically add your name to the guest list to hear from Jeff about this strange phenomenon and how you can take advantage of these windows.

Many investors are familiar with buying options. Fewer are comfortable with selling them.

When you sell an option, you hope it expires worthless – or that you can buy it back at a lower price.

You receive a premium for selling the option, which means this can be a great income-generating strategy. However, it also comes with increased risk if the trade goes against you.

Spreads are one of the most popular options strategies for that reason. A spread is when you simultaneously buy and sell options on the same underlying asset at the same time. This can help you generate income while also putting a cap on potential losses.

It’s a strategy I recommend in my options advisory, The S&P Trader. So today, let’s look at how it works…

One of the common spread trades I use is a “Bear Call Spread.”

We are bearish about a stock, and the strategy uses call options. In this case, we are going to buy and sell call options (a spread).

We’ll look at an example using the S&P 500 (SPX). Please note that this is just an example and not a trade recommendation…

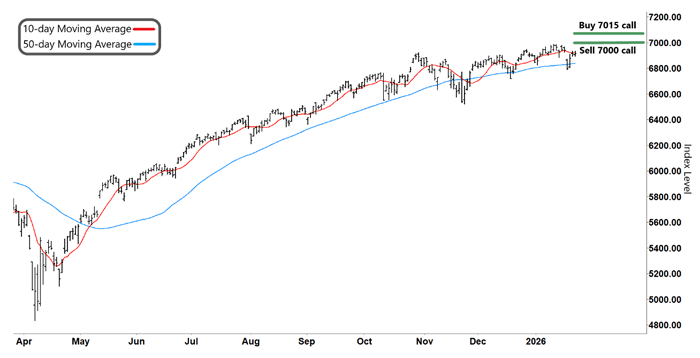

S&P 500 Index (SPX)

Source: e-Signal

SPX retraced off its recent peak. The price action suggests that SPX is tired and buyer momentum is waning. So in this example, we may believe that it’s unlikely to break higher in the short term.

There’s a whole range of geopolitical issues (including Greenland, Russia, China, Taiwan, and the Middle East). And the re-emergence of tariff threats increases the prospects of a trade war. That’s never good for the markets.

Plus, most of the Magnificent Seven stocks are floundering. Combined, they represent one-third of the S&P 500’s weighting. So we may think that SPX will struggle to break and hold above 7000 in the near future.

In that case, we can decide to place a bear call spread…

The idea when you place a bear call spread is to sell a call leg at a level where you don’t think it will be exercised. In this example, I’m looking at 7000. Note that the closer the strike price is to the current index level, the more premium you’ll receive. However, the closer it is, the higher the chance of being exercised.

If we just sold the call option by itself, we could be setting ourselves up for big losses if SPX broke through the 7000 level and kept rallying. That’s where the second leg of the spread trade fits into the picture. In effect, the higher strike price on the bought call protects us like a stop loss.

By simultaneously buying a call at the 7015 level, we cap our losses if SPX were to rally strongly.

The important thing to remember with spreads is that you always use the same expiration date with both options. And although there are two legs to the trade, you treat the trade as one position.

So let’s break down the numbers to see how it works…

In our example, let’s say we receive $3 for selling the 7000 call option. (Because one options contract covers 100 shares, that equates to $300 per contract.)

However, we need to buy the 7015 call option to protect us in case SPX rallies. If we pay $1.20 (or $120 per contract) for the 7015 call option, we’d receive a net $1.80 (or $180 per contract) for doing the trade.

If SPX closes below 7000 on expiration day, all of that premium remains ours to keep.

However, if SPX moves above 7000, that starts to eat away at our premium. If SPX rallies strongly and closes above 7015 at expiration, our maximum loss would be the difference between the strike prices (7015 – 7000 = 15 points, or $1,500) minus the premium we received ($180).

At first glance, that might seem like an asymmetrical risk/reward equation. But our strategy maintains such a high winning percentage (typically above 80%) that this strategy can be incredibly profitable. In fact, this is one of the most effective strategies I’ve used over my 40-year career… including the 20 years I went without a losing year.

Plus, volatility can also impact this strategy significantly. Higher volatility often boosts options premiums (though we have to balance this with the risk of more dramatic market moves against our trade).

In the end, this is a strategy you want to have in your back pocket… especially if you’re looking for a fresh source of trading income.

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.