Bitcoin (BTC) burst through the $120,000 level earlier this month (topping out around $123,278). That earned it plenty of headlines…

Predictions flew about how high it was headed next.

But there’s a common theme with BTC… And just as it pulled in a whole new wave of FOMO buyers, it reversed and faded lower. In the space of two weeks, BTC gave back around $8,500 of its gains.

By capturing a part of that move, my subscribers picked up a 17.7% gain in four days.

And we did it without holding a single Bitcoin. I trade BTC differently from many folks. And I’d like to share my strategy with you today…

I trade Bitcoin through an ETF like the iShares Bitcoin Trust ETF (IBIT). IBIT tracks the price of BTC. But because it’s listed on a regulated exchange, it has far more regulatory oversight than a digital wallet or crypto exchange.

So you can trade it with the usual protection and convenience of a brokerage account. And I like to add another layer to my strategy by using options…

By buying an option on IBIT, I can take part in a move in either direction – whether Bitcoin rises or falls. If the move I expect doesn’t happen, the most I can lose is the premium I paid for the option.

And that’s what we did with IBIT…

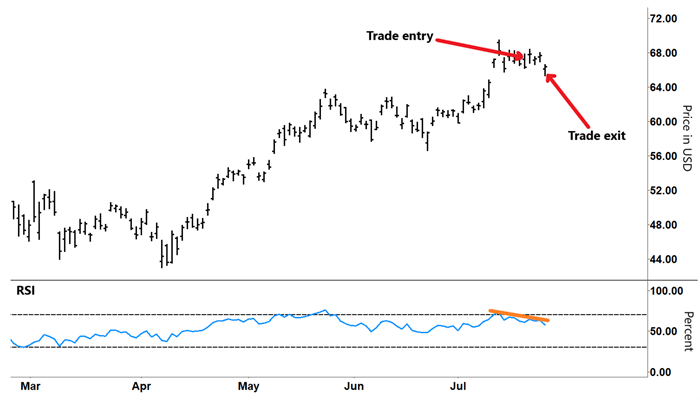

The chart of IBIT below shows its peak on July 14. That coincided with the Relative Strength Index (RSI), a momentum indicator, inverting from overbought territory. That’s a bearish signal.

The price action at the peak added to the bearish narrative.

After opening higher on the day, IBIT soon reversed. It closed down around its daily low – evidence that buyers lacked conviction…

iShares Bitcoin Trust ETF (IBIT)

Source: eSignal

As momentum continued to fade (orange line), IBIT slid lower.

So we bought a put option on July 21 at $3.10. (That’s $310 per option contract – each contract is for 100 shares.)

As the chart shows, IBIT tried to rally over the following days. But those moves soon faded out.

Then, IBIT opened lower on Friday with a further fall in momentum. That sent our position in profit, and we decided to take that profit off the table.

We exited our position at $3.65 (or $365 per contract) – a handy 17.7% gain in just four days.

|

Tune in to Trading With Larry Live Each week, Market Wizard Larry Benedict goes live to share his thoughts on what’s impacting the markets. Whether you’re a novice or expert trader, you won’t want to miss Larry’s insights and analysis. Even better, it’s free to watch. Simply visit us on YouTube at 8:30 a.m. ET, Monday through Thursday, to catch the latest. |

To be clear, options magnify gains and losses. And because options expire, the clock is always ticking…

If the move you planned for doesn’t pan out within your time frame, you can lose all the premium you paid for the option. (In this case, we were risking $310 per contract.)

But as this trade shows, by using options to gain exposure to IBIT, we can profit even when Bitcoin is falling. And we don’t need to use a digital wallet or a crypto exchange.

And because we know exactly what our maximum potential loss is before we place our trade, our risk is clearly defined.

That makes this a strategy worth having in your pocket. And if you’d like to join me for my next trade recommendation, you can learn how right here.

Regards,

Larry Benedict

Editor, Trading With Larry Benedict

|

Free Trading Resources Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out. |

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.