Larry’s Note: What if you could eavesdrop on America’s most powerful CEOs’ phone calls?

You can. In fact, the SEC forces it to happen every quarter.

I’ve been listening in on these calls for 40 years… and I’ve made as much as $10 million in a single day from what I’ve heard.

And now I’m sharing what I listen for on these calls, including eight signals that help me spot big market moves forming. These signals can hand you thousands of dollars if you’re paying attention and can act quickly.

On February 11, at 8 p.m. ET, I’ll share the full details for the first time ever. So if you haven’t yet, RSVP with one simple click right here.

Even for an asset known for its volatility, cryptocurrencies’ plunge has been brutal.

Nearly $2 trillion has been wiped out from the total crypto market value in just the past four months. Not even the largest crypto by market cap has been spared. Bitcoin tumbled to its lowest level since late 2024.

That’s leaving Bitcoin’s strongest proponents facing heavy losses. Michael Saylor’s firm, Strategy, just reported fourth-quarter financial results.

The company is known for frequent Bitcoin purchases that it holds on its balance sheet. It reported an operating loss of $17.4 billion, which was driven almost entirely by unrealized losses linked to its Bitcoin holdings.

The quarterly loss is one of the largest in corporate history, rivaling those posted by companies during the 2008 financial crisis.

Yet Saylor continues preaching the HODL (“hold on for dear life”) mantra.

So today, let’s take a look at Bitcoin and see if the chart suggests a turnaround or more pain to come…

Bitcoin is known for wild price swings, but its recent action has been abysmal.

That comes despite a crypto-friendly administration in Washington, D.C., which is eager to pass legislation boosting the crypto industry.

Likewise, the introduction of spot Bitcoin exchange-traded funds (ETFs) in 2024 made it easier than ever for investors to add Bitcoin to their portfolios. And investors were eager. In fact, the iShares Bitcoin Trust (IBIT) set records for the fastest growth in assets under management ever, reaching $100 billion in less than two years.

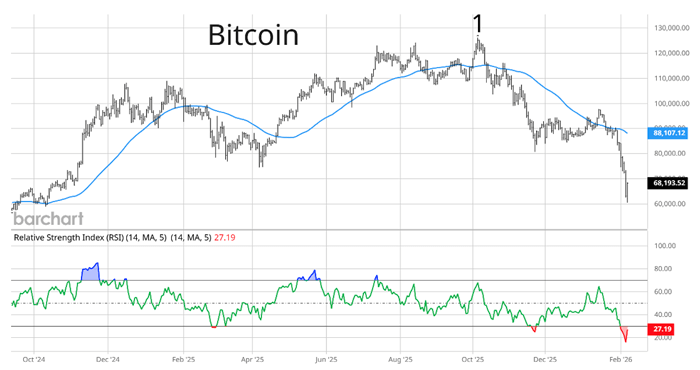

Yet despite the positive backdrop, Bitcoin peaked nearly five months ago and has struggled for traction ever since. Here’s the chart:

Bitcoin looked set to soar to new record highs after breaking out above $120,000 at “1” back in October.

But that failed breakout was the first warning that Bitcoin’s trend was changing. From there, Bitcoin quickly crossed below the 50-day moving average (MA – blue line) and couldn’t even find traction at the psychologically important $100,000 level.

Bitcoin appeared to be putting together a rally attempt when the price started testing the $85,000 area, which was last seen during the lows of the sell-off into the trade war last spring.

But Bitcoin has even sliced below those levels. On the face of it, it looks like there’s no end in sight to Bitcoin’s sell-off.

But the move late last week is getting extremely stretched to the downside, which could be setting up a massive mean reversion trade…

Cryptocurrencies, including Bitcoin, surged following President Trump’s 2024 election win on the hope that crypto-friendly policies would boost the industry.

But Bitcoin’s latest plunge has brought it back to levels seen before the election.

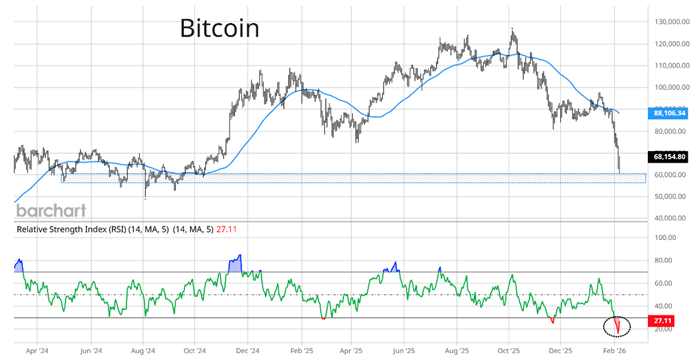

This most recent leg lower is triggering some of the most extreme oversold levels ever seen in Bitcoin’s history. Take another look at the chart:

First, note the distance that Bitcoin has extended below its 50-day MA. As of writing, Bitcoin sits 28% below the 50-day, which ranks in the bottom 5% of all historical observations.

And take a look at the Relative Strength Index (RSI) in the bottom panel. The RSI fell as low as 16 (circled area) during this drop. There is only one other time in Bitcoin’s entire history when the RSI has been lower. After that instance at the end of 2018, Bitcoin more than doubled in six months.

Conditions point to some of the most oversold levels ever seen for Bitcoin, with its price now testing the $60,000 level. That’s support from late 2024.

At the same time, an index measuring fear and greed in crypto points to extreme fear. That’s also a bullish contrarian signal.

This is where our mean reversion strategy can come into play.

Even if it’s short-lived, Bitcoin appears positioned for a bounce. And if you can catch the move just right, you could end up with serious profits.

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.