Oil prices are having a hard time shaking off bearish sentiment.

Oil demand isn’t keeping pace with an oversupplied market. That’s due to huge production increases (and record output) across key oil-producing regions around the world. A massive oil glut is expected to hit the market next year.

President Trump is also pushing for an end to the conflict between Ukraine and Russia, which would benefit the oil supply.

That’s pushing oil prices toward the lowest levels seen since 2021.

But don’t expect oil prices to stay at these levels for long.

Let me show you the key oil price level at play… and why that could lead to a rebound in oil prices.

The global oil market is facing a massive supply glut, which is keeping a lid on prices.

The U.S. is the world’s top producer. Production hit a record 13.6 million barrels per day (bpd) in July. The U.S. Energy Information Administration expects output to hit record levels this year overall as well.

Additionally, the OPEC oil cartel has boosted output targets by 2.9 million bpd this year. The cartel expects to increase production by another 137,000 bpd next month.

At the same time, the demand outlook has only been revised modestly higher.

With supply outpacing demand, the International Energy Agency is forecasting an oversupply of four million bpd next year. That’s about 4% of global demand, which means an imbalance across supply and demand will continue to pressure oil prices.

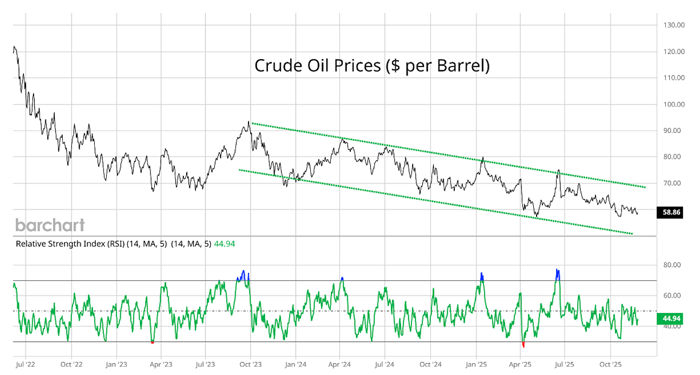

Take a look at the chart below.

Since late 2023, oil prices have been stuck in a downtrend, with a series of lower highs and lower lows (trend channel).

Oil prices are once again trading near the lowest levels seen over the past four years. But oil is now approaching a critical level that has seen prices reverse higher on two other occasions this year.

That’s because the oil market’s major players can’t let prices stay this low for long.

Key oil-producing regions don’t want to see oil prices dip much further.

Many OPEC producers, including Saudi Arabia, need oil prices at much higher levels to balance their national finances. In simple terms, oil needs to stay above a certain price level for them to make enough money.

Even U.S. producers are estimated to have a breakeven point of $60-70 per barrel. That’s important to note because the U.S. has emerged as a key “swing producer” in the global oil market. That means domestic producers can adjust output more quickly than other regions.

While 2025 has seen key regions boosting production, that could flip the other way if oil prices continue trading at these levels. The current price discourages investing in new production and drilling new wells. In fact, the number of active oil rigs in operation in the U.S. is already down 33% from the recent peak seen in 2023.

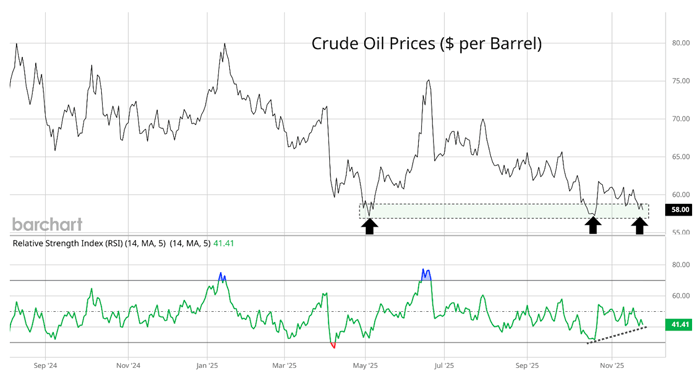

So prices are trading near levels that would curtail production. At the same time, a potentially bullish setup is emerging in oil’s chart. Take another look at oil prices.

Oil is testing a key support level that has seen prices reverse higher this year.

This most recent test could also show a positive divergence on the Relative Strength Index (RSI). The RSI is making a higher low as oil falls back toward the $57 level. That shows downside momentum is fading on the most recent move lower.

An uncertain production outlook and bullish chart setup could see oil prices rebound off the $57 level once again. That could create an interesting trading opportunity for those who are prepared…

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.