After a massive bull run, much of Big Tech struggled at the end of last year.

And while the S&P 500 and Dow Jones have again hit all-time highs this week, the Nasdaq is still trading well below its October peak due to the rotation out of tech…

We need to be aware of changing trends and not get caught overexposed to yesterday’s market darlings.

Likewise, you shouldn’t get stuck trading the same old stocks. You need to see what other opportunities are out there, just as we’ve done in my entry-level trading service, One Ticker Trader…

For example, we’ve notched four winning oil trades, using options on the United States Oil Fund (USO) – an ETF that tracks the WTI crude oil price.

Better still, we clocked 16.6%, 87.2%, 25.5%, and 77.8% wins with quick turnarounds. So let’s check how this latest trade played out…

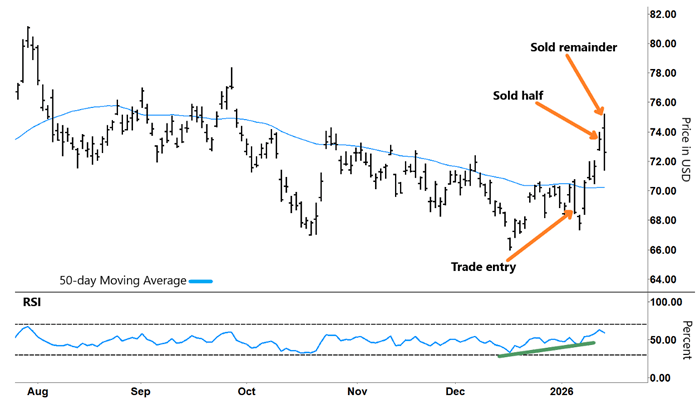

The 50-day moving average (MA, blue line) in the chart below shows USO’s downtrend. That down move developed after USO retraced off its June 2025 peak and made a series of lower highs and lower lows. Check out the USO chart below…

United States Oil Fund (USO)

Source: eSignal

As we discussed when we ran through our previous USO trade, oil made a number of counter-rallies throughout that down move. That provided the setup to profit.

After initially rallying off the news of the capture of Venezuelan President Nicolás Maduro and his wife, USO retraced the next day. Many rationalized that this could open up Venezuelan oil fields (with the largest reserves in the world), adding to the oil glut. That would be bearish for the oil price.

But any redevelopment of those fields would take years and huge amounts of capital – if any U.S. oil majors could be convinced to invest there at all…

Plus, rising uncertainty around oil due to geopolitical events makes it hard to tell where things are going to land. That can often cause a short-term spike in the oil price.

So with momentum already on the rise, we decided to buy a USO call option on January 6 to capture the anticipated move. (A call option benefits when the underlying asset rallies.)

We were slightly early with our trade, but USO bottomed out the next day, making a higher low. That move coincided with the Relative Strength Index (RSI) making a higher low too (green line).

From there, USO ripped higher as the RSI accelerated into its upper band, closing above its 50-day MA. And after holding that level, it gapped higher again…

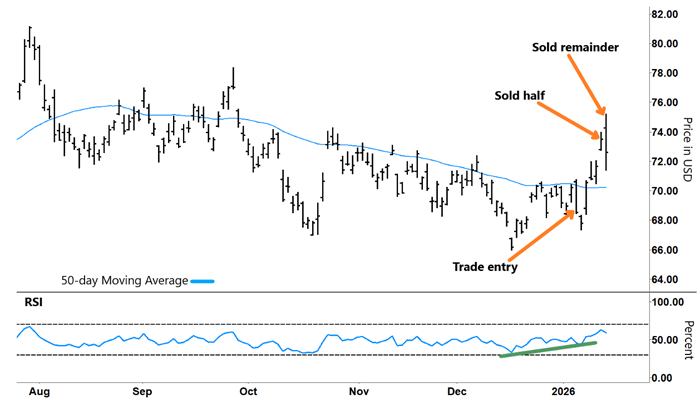

Take another look:

United States Oil Fund (USO)

Source: eSignal

That sharp rally enabled us to take some profits off the table on January 13 by closing half our position. And then when USO opened higher and rallied the following day, we decided to close out the remainder of our position.

All said, we generated a 77.8% blended gain over just eight days.

It shows how using options with the right trade setups can lead to sizeable profits.

To be clear, options magnify both gains and losses. And because options expire, the clock is always ticking away.

If the move you anticipated doesn’t pan out relatively quickly, you can lose the premium you paid for the option. But your risk is always clearly defined… and as you can see, successful trades can reward you just as quickly.

Plus, if you look beyond popular themes everyone else is trading, you’re sure to find plenty of opportunities in the markets to capture quick profits.

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

P.S. Look at these gains:

57% in Apple 12 days…

66% on Nvidia in 4 days…

50% on Bitcoin in 5 days…

82% on Tesla in 4 days…

134% on Meta 2 days …

It’s happening again and again. And you know why? A “v-pattern” appeared before big price moves. It’s all tied to Wall Street’s growing use of artificial intelligence.

I shared all the details at Get Rich Slow last night. If you missed out, then be sure to watch the replay now while it’s still available. You can find it right here.

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.