Larry’s Note: Every quarter, the CEOs of America’s biggest companies are required to get on a phone call and answer tough questions from Wall Street analysts.

Apple. Amazon. Tesla. NVIDIA. The biggest banks. Defense contractors. All of them.

These calls are open to the public. Anyone can listen. Some of you probably already do. But here’s what most people don’t understand:

There are eight key signals to listen for on these calls. These are the signals that actually move markets. I once heard one of these signals, and it led to a $10 million payday at my hedge fund.

The same call everyone else was on. Different outcome – because I knew what to listen for.

Tonight at 8 p.m. ET, I’m revealing how anyone can make money by getting on these calls and listening for these signals.

Click here to automatically save your seat for tonight’s free briefing.

Earlier this week, we looked into the cryptocurrency carnage that’s happened since the crypto market peaked in 2025.

The largest crypto, Bitcoin (BTC), peaked at over $126,000 on October 6. But its recent low has more than halved that price. And the second-largest crypto, Ethereum (ETH), has fared even worse…

Since topping out just below $5,000 in August last year, ETH lost around two-thirds of its value as of its February 6 low. It’s another reminder of how brutal sell-offs in the crypto space can be.

But instead of fixating on the carnage, we identified a promising trade setup brewing. And by being nimble, subscribers to The Opportunistic Trader snared a 14% gain in a single day.

So let’s run through the trade to see how things played out…

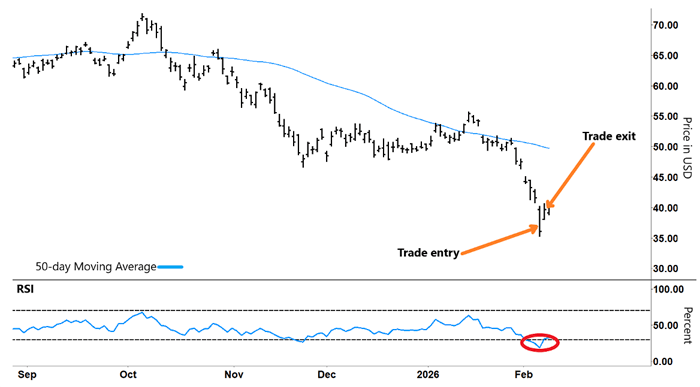

In the chart of the iShares Bitcoin Trust ETF (IBIT) below, you can see where it peaked back in October. It made a series of lower highs and lower lows that coincided with the 50-day moving average (MA, blue line) rolling over and falling. Check out the chart…

iShares Bitcoin Trust ETF (IBIT)

Source: eSignal

After initially breaking back above the 50-day MA at the start of this year, IBIT reversed sharply and accelerated lower as buying momentum collapsed. That move put the Relative Strength Index (RSI) well into oversold territory (red circle).

This was the second most oversold level in Bitcoin’s entire history. Plus, Bitcoin was sitting around 28% below its 50-day MA – a level more extreme than 95% of the previous data.

This provided evidence of just how oversold BTC had become – and why it was a candidate for my mean reversion strategy. That’s when I look for an asset that has become way overbought or oversold and aim to profit when it snaps back the other way.

I use options to capture those moves. They enable me to take part in a potential move at a fraction of the cost of buying shares. Plus, when you buy options, your risk is capped to what you pay for the option(s).

So to take advantage of IBIT’s anticipated rebound, we bought an IBIT call option on February 5. A call option typically increases in value when the underlying asset rallies. The option cost $4.13 per contract, which equates to $413 (an option contract is for 100 shares).

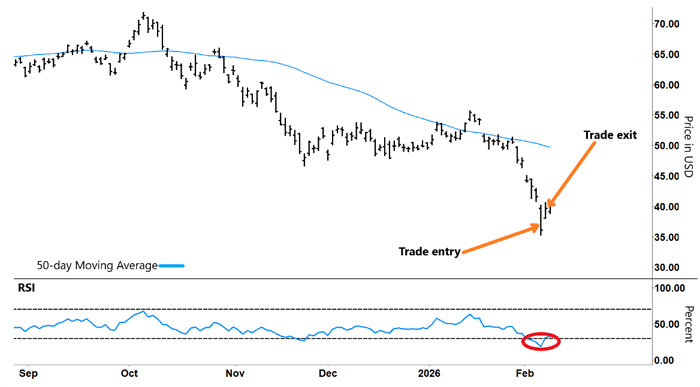

As the chart shows, we got our timing right. Take another look:

iShares Bitcoin Trust ETF (IBIT)

Source: eSignal

The RSI formed a “V” and rallied out of oversold territory, causing IBIT to sharply rebound.

We were keen to bank our profits due to the volatility of the move, so we closed out our position the very next day at $4.70 per contract (or $470). That equates to a 14% profit in a day.

To be clear, options magnify both gains and losses…

And because options expire, you need to get the move you anticipated within your time frame. Otherwise, you can lose some or all the premium you paid for the option.

Yet by using options, you can gain exposure to BTC’s moves and profit from whichever direction BTC takes. And as we saw with this trade, you can generate a nice profit in a short time.

Looking ahead, I’m expecting volatility to increase and provide plenty of opportunities in the year ahead. And a great way to capture those moves is by trading options.

So if you’d like to learn more about the opportunities I’m watching in the near future, be sure to tune in to tonight’s Wall Street Money Calls event at 8 p.m. ET. There’s just a short time left to sign up to attend right here.

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.