Managing Editor’s Note: Tonight at 8 p.m. ET, our colleague Jeff Brown is having an online strategy session to tell you about his latest AI breakthrough.

Cryptocurrencies are among the most explosive assets in history. Bitcoin alone has minted countless millionaires. But they are also incredibly volatile.

Investing in cryptos can feel like riding a roller coaster… with extreme ups and downs. But what if you could capture most of the upside of cryptos while avoiding all those nasty downturns?

That’s what Jeff will be discussing tonight at his strategy session. And if you’d like to attend, there are just a few hours left to RSVP. To save your seat with one click, simply go right here.

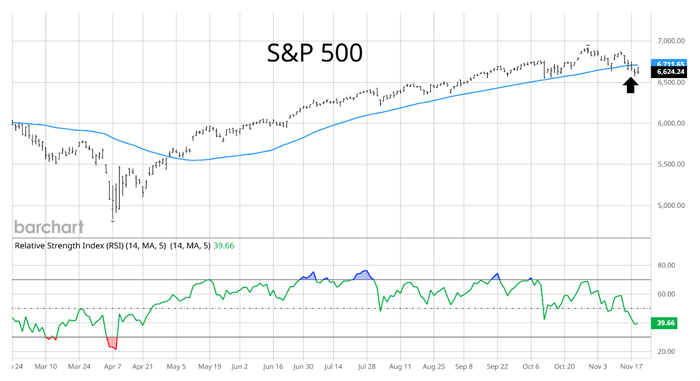

For the first time in 138 days, the S&P 500 closed below its 50-day moving average (MA – blue line) this week.

That was the longest streak trading above the key support level since 2007.

While investors grew accustomed to an easy trading environment, I’ve been highlighting the growing warning signs of a pullback in recent months.

That includes Bitcoin’s inability to keep pace with the S&P 500 since the summer. The largest crypto by market cap has fallen 27% from its peak.

We’ve also noted the sharp deterioration in stock market breadth, which is how you measure participation in a trend. (Fewer stocks in the trend = a weakening trend.) While the S&P 500 was making new highs near the end of October, less than half of the stocks in the index were trading above their own 50-day MA.

And don’t forget the repeating CBOE Volatility Index (VIX) pattern I showed you that warned of higher volatility levels.

Yet while the recent action might feel bad, the main catalyst of the pullback is just getting underway… and that means this might only be the start.

The narratives around the recent drop in the stock market seem to change every day. But the real driver of this down move comes back to just one catalyst: the outlook for interest rate cuts from the Federal Reserve.

The market odds for another 0.25% cut at the Fed’s December meeting are now a coin flip. Those same odds stood at 94% favoring another cut just a month ago.

Plus, the market is projecting only three cuts in total through next year.

The Fed has played a key role in boosting stock prices through loose monetary policy ever since the central bank started cutting rates in late 2024.

But now that catalyst could be going away. And trust me, we’ve seen nothing yet when it comes to Fed-induced volatility in the stock market.

Remember, the recent pullback in the market comes from the mere outlook for fewer rate cuts. The Fed is still expected to lower rates, just not as much as initially expected.

It’s a clear sign of how sensitive the market has become to interest rates – and its addiction to easy money to fuel more gains.

It also means the real fireworks haven’t started yet…

Throughout its history, the Fed has played a key part in the stock market’s biggest booms and busts. Loose monetary policy helps inflate asset prices, but tighter policy eventually catches up.

Over the past 25 years, the S&P 500 saw rallies give way to major bear markets in 2000-2002, 2008-2009, 2020, and 2022.

Every single bull run began with rate cuts. Each bear market occurred after the Fed had to reverse course and tighten policy.

That’s why you need to pay close attention to how the rate outlook keeps shifting.

The market reaction to a slowing pace of rate cuts reveals a weakness in speculative assets like stocks and crypto.

The nosebleed valuation levels and excessive speculation and risk-taking by investors can keep running high for a long time.

But when the foundation starts to shake, these are some of the first asset classes to wobble with it.

Many might rationalize that the recent market action is just a rough patch in the rally.

But if the outlook for rate cuts keeps dropping, volatility could really go through the roof… and we could see vulnerable areas of the market show some real downside as that reality hits…

Happy Trading,

Larry Benedict

Editor, Trading With Larry Benedict

Reading Trading With Larry Benedict will allow you to take a look into the mind of one of the market’s greatest traders. You’ll be able to recognize and take advantage of trends in the market in no time.