|

Larry’s note: Welcome to Trading with Larry Benedict, the brand new free daily eletter, designed and written to help you make sense of today’s markets. I’m glad you can join us. My name is Larry Benedict. I’ve been trading the markets for over 30 years. I got my start in 1984, working in the Chicago Board Options Exchange. From there, I moved on to manage my own $800 million hedge fund, where I had 20 profitable years in a row. But these days, rather than just trading for billionaires, I spend a large part of my time helping regular investors make money from the markets. My goal with these essays is to give you insight on the most interesting areas of the market for traders right now. Let’s get right into it… |

Today, I’m turning our attention to a part of the market that seems to have been under the radar these past few months… the industrial sector.

After all, these days investors seem to be totally consumed by tech stocks.

But to me, the industrial sector is the engine room of the economy. And because it covers such a diverse array of industries, it gives valuable insight into how the economy is performing.

Think Boeing, FedEx, and Honeywell… Or even Caterpillar, 3M, and GE.

These are huge companies with hundreds of thousands of employees. Their influence and reach across the economy is vast.

That’s why I keep such a close watch on this sector. And its price action over the last four to five months has left me scratching my head.

One way I keep an eye on this sector is through the Industrial Select Sector SPDR ETF (XLI).

So let’s pull up the daily price chart…

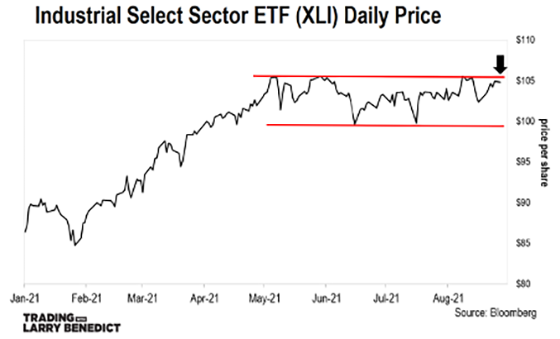

Much like the broader market, XLI rallied strongly off its March 2020 low. From trading briefly below $48, XLI rallied to just under $107 in May this year.

(Note: To make it easier to see, I’m just showing the XLI chart back to the start of this year).

That represents over a 120% rally in around 14 months… A huge move for what some might consider to be an “old” part of the economy.

However, after topping out in May, the price pattern for XLI changed. XLI tried, but failed, to make a new high in early June. Instead, it fell back below $100, meaning that the uptrend had come to an end.

Since then, XLI has been trading sideways.

The two red horizontal lines represent the upper and lower bands of XLI’s current trading range. XLI has been trading in a tight $5-$6 range since May.

However, also since May, the S&P 500 (SPX) has rallied around 12%, and the Nasdaq has rallied over 17% over the same time…

Clearly this is telling me that the rally in SPX is being driven purely by tech. Industrial stocks have been totally left in their wake.

And that’s why I’m trying so hard to figure out what’s going to come next…

One possibility is that the Nasdaq will have a correction and bring the SPX down with it – though not as dramatically.

Or…

XLI will break out of its range and move higher. In doing so, it’ll play “catch-up” with the SPX.

That’s why the upcoming price action in XLI is key.

XLI is right on the cusp of touching the upper red line (black arrow). If it breaks through that level and holds it, XLI could be in for a substantial move higher.

However, if XLI hits resistance and falls lower again, then any further rally in the SPX will remain dependent on tech stocks.

Meaning if the Nasdaq rolls over, then so too will the SPX.

Regards,

Larry Benedict

Editor, Trading With Larry Benedict

P.S. I want to let you in on an insider secret… it’s something I call “the 7-day blitz.” It’s a rare event in the markets where volatility skyrockets, creating opportunities to make life-changing gains in a matter of hours.

All it takes is just one ticker to take advantage of this event that Wall Street’s been using for years… However, most investors have never even heard of it…

So, that’s why next Wednesday on September 8 at 8 p.m. ET I’ll be revealing my tell-all on “the 7-day blitz”… and even sharing the only ticker you need to trade it. For more details, and to reserve your spot, click right here.

Reader Mailbag

I’d like to thank all of my readers for your kind words…

Hi Larry, thanks for your articles. Finding a mentor that suits you is really difficult. First step is to know who you are and what suits you. Living in Australia, I found I don’t like day trading the U.S. market as not only do I have to trade from 11 p.m. to 6 a.m. which doesn’t suit my metabolism… but I don’t have a life.

Money is not the only thing in life. You are a breath of fresh air as so many just want to milk my pocket. Thanks for paying it forward

– John P.

Very insightful information. Thank you.

– Kirk L.

P.S. We’re excited to hear what you think of your new eletter, Trading With Larry Benedict. Let us know at [email protected].