|

Larry’s note: Welcome to Trading with Larry Benedict, the brand new free daily eletter, designed and written to help you make sense of today’s markets. I’m glad you can join us. My name is Larry Benedict. I’ve been trading the markets for over 30 years. I got my start in 1984, working in the Chicago Board Options Exchange. From there, I moved on to manage my own $800 million hedge fund, where I had 20 profitable years in a row. And, I’ve been featured in the book Market Wizards, alongside investors like Paul Tudor Jones. But these days, rather than just trading for billionaires, I spend a large part of my time helping regular investors make money from the markets. My goal with these essays is to give you insight on the most interesting areas of the market for traders right now. Let’s get right into it… |

Just a year ago, inflation simply wasn’t on anyone’s radar.

No chatter on the news networks…

And no talk of hiking up interest rates.

Fast forward to today… things have changed. You won’t find a financial news site anywhere where inflation isn’t the major story.

And with the Fed finally declaring the word “transitory” to be dead and buried, we all know that inflation isn’t going away anytime soon.

Today, instead of harping on about the ills of inflation – or questioning why the Fed didn’t act sooner to raise rates – I want to take a deeper dive into what higher inflation really means for the economy and the markets.

To do that, I’m going to begin with the latest retail sales data that came out a week ago…

Is Omicron or Inflation To Blame?

Coming into the holiday season, usually you’d expect to see a jump in retail sales. But before releasing the latest data for December sales, consensus analysts’ forecasts predicted that sales would be flat.

What the market didn’t expect, however, was a negative number. After four months of growth, December retail figures came in at -1.9%. That’s the biggest drop since February 2021 when retail sales fell 2.9%.

I follow retail sales closely because of how important they are to private consumption – the biggest driver of the economy. (Remember, we checked out the SPDR S&P Retail ETF (XRT) on Tuesday).

While some experts were quick to blame the surprise drop in sales on the Omicron strain of the coronavirus, I’m not so sure. When you delve into the figures behind that drop, one thing stands out…

Non-store retailers (e-commerce businesses) saw the biggest fall in sales at -8.7%.

If consumers didn’t want to go out due to Omicron – but still had the urge to spend – then you’d expect non-store sales to be more robust.

With gas prices up nearly 50% since last year, and food and rent up 6.5% and 4.1% respectively, clearly consumers are starting to feel the effects. With more of worker’s paychecks committed to covering the basics, there’s simply less money to spend.

And that means stocks reliant on discretionary spending will also feel the pain.

While retail sales are a great way to gauge consumer spending (and thereby the economy), there’s something else that can give an even broader picture of consumption and inflation.

Still Expanding… But Cost Pressures Are Building

One of the most widely watched economic indicators will come out on Monday… the Purchasing Managers’ Index (PMI). The PMI surveys a broad range of purchasing managers each month to gauge economic conditions.

Information provided by the managers includes sales and new order numbers, inventory levels, employment, and input prices. Because purchasing managers are the first to see a change in input costs, they can give an early indication if those prices are rising.

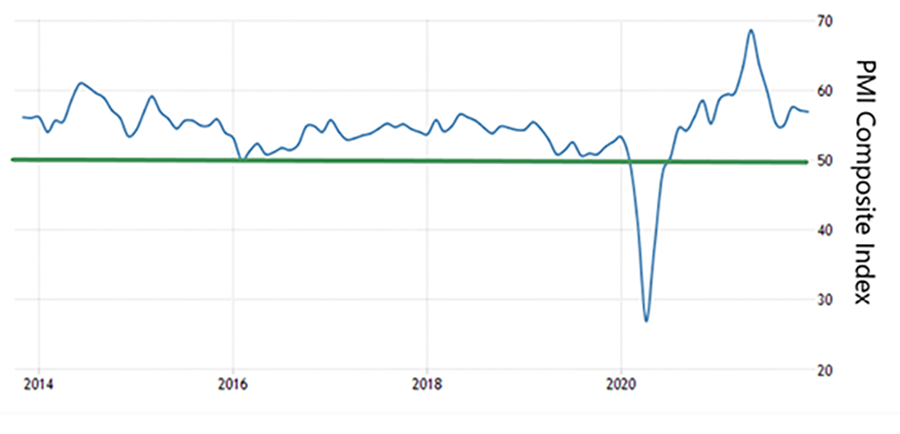

This data is then combined… represented by the chart below. This is a composite PMI that combines both manufacturing and service industries…

United States Composite PMI

Source: Trading Economics

A reading above 50 means that business activity is positive and expanding… below 50 means business conditions are negative and deteriorating.

For much of the last eight years, the chart shows the PMI predominantly tracked along between 50 and 60, which is generally positive.

However, there was a particularly wild swing during the peak of COVID – from less than 30 in March 2020 right up to a high of nearly 70 in May 2021. Last month, the Composite PMI came in with a 57.6 reading.

While that showed a healthy increase in business activity, job creation numbers only increased slightly. For many businesses, hiring and retaining key staff was becoming more of an issue.

A shortage of key materials and inputs, along with continued disruption in supply chains, were also becoming a much bigger factor. Data showed input costs in December to be tracking at extreme highs.

Unless there’s a circuit breaker to this increase in costs, then eventually demand for those services will drop as prices become too high… And that will have major implications for both manufacturing and services companies.

So as inflation tightens its grip on the economy, stocks across the market are going to come under even more pressure.

Regards,

Larry Benedict

Editor, Trading With Larry Benedict

Reader Mailbag

How has inflation affected your retail purchases?

P.S. We’re excited to hear what you think of your new eletter, Trading With Larry Benedict. Let us know at [email protected].