Investors are too aware of rising interest rates’ impact on stocks – especially tech stocks – after the past year.

However, it wasn’t only stock investors who felt the pain…

Rising interest rates also hit Treasury bonds. That’s because when higher yields are on offer, that reduces the value of existing lower-yield bonds.

This scenario saw the iShares 20 Plus Year Treasury Bond ETF (TLT) drop a massive 38% from the start of 2022 until it bottomed out in October.

But like any other market, bonds can overshoot…

And with the market starting to price in fewer and smaller rate hikes (despite the Fed’s jawboning) – and even potential rate cuts – TLT began to rally off its 2022 lows.

When TLT made a higher low and again began to rally, we had the perfect setup for a long trade with my Opportunistic Trader options advisory service…

So, let’s take a look at this trade today…

The End of a Downtrend

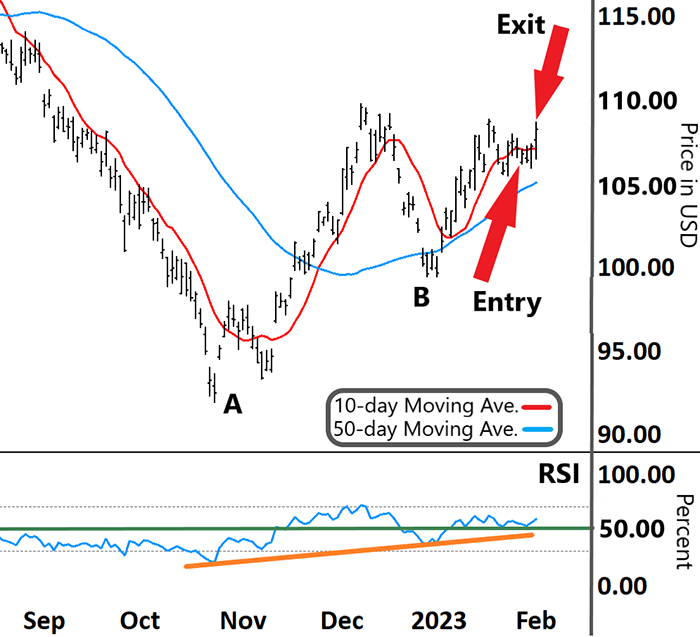

In the chart of TLT below, you can see the tail end of the strong downtrend that bottomed out in October at ‘A’…

iShares 20 Plus Year Treasury Bond ETF (TLT)

Source: eSignal

This down move coincided with two strong bearish signals…

-

The Relative Strength Index (RSI) remained stuck in the lower half of its range.

-

The 10-day moving average (MA – red line) tracked below the 50-day MA (blue line), with both MAs trending down.

However, the RSI formed a ‘V’ in oversold territory (lower grey dashed line) and then tracked higher. And TLT locked in its bottom on October 24 at ‘A’ and then began to rally.

The RSI then bullishly broke up through resistance, and the 10-day MA broke back above the 50-day MA. And TLT rallied up to its peak on December 7.

But this time, it was an inverse ‘V’ from the RSI in overbought territory (upper grey dashed line) that saw TLT reverse.

This pullback ended with the RSI forming a double ‘V’ at a higher low (orange line). This coincided with TLT also bullishly making a higher low at ‘B’…

TLT then continued to rally as the RSI broke back into the upper half of its range. And the 10-day MA began to accelerate above the 50-day MA.

The RSI then tested and held support multiple times (green line). So, we entered a long position by buying a call option on TLT on January 27.

(Note that a call option increases in value when a stock price rises.)

Free Trading Resources

Have you checked out Larry’s free trading resources on his website? It contains a full trading glossary to help kickstart your trading career – at zero cost to you. Just click here to check it out.

Quick and Tidy Profits

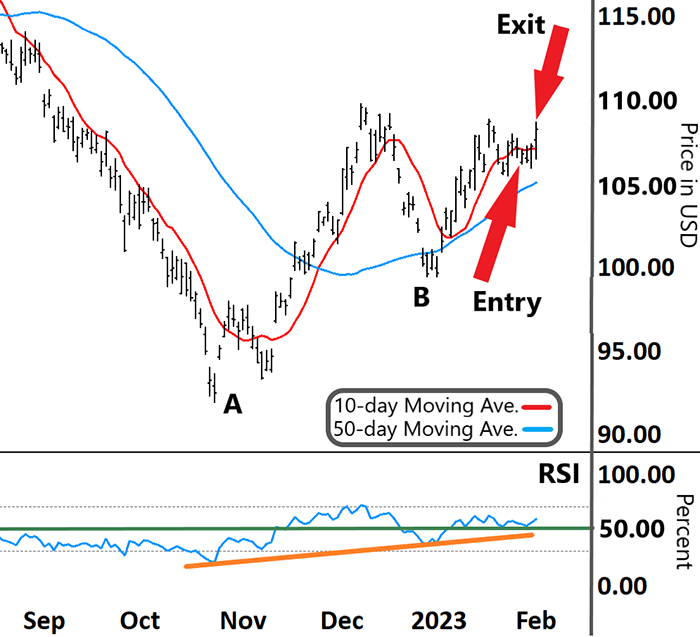

As you can see, TLT drifted sideways for a few days after entering our position.

But it then continued its rally, and our long position became profitable. So we closed out our position on February 1 by selling our call option.

Take another look…

iShares 20 Plus Year Treasury Bond ETF (TLT)

Source: eSignal

In all, that trade generated a handy 30% return in just five days (including a weekend).

As always, I want to be clear that we generated this return using options. Because options have a finite life, the clock is always ticking. Yet options can help amplify your returns as well.

With the right strategy and a strong setup, we can generate quick and tidy profits… That’s our goal at The Opportunistic Trader.

That stays true even if we capture just a portion of the overall move in a stock.

The key is to stick with your strategy and bank your winners when you see them. Then be ready to quickly move on to your next trade.

Regards,

Larry Benedict

Editor, Trading With Larry Benedict

Reader Mailbag

In today’s mailbag, a One Ticker Trader member shares his thoughts on Larry’s services…

Larry, I appreciate all that you do and it’s amazing to see your mind at work. I just opened my TOS account about a month ago and we have made several trades. I actually started a year ago with Jeff Clark, but before I got started my business took off and I had to focus on that again.

I’m moving very slowly and suffering one loss that your risk-averse strategy had us sell half and profit. So, I’m mitigating the eventual loss leaving me with a profit of $400 the first month. So, I’ll continue with your One Ticker Trader and Jeff’s One Stock Retirement giving me three to four positions a month.

I’m interested in trading the SPX daily with your S&P 500 and 24-hour payout as it sounds great, but I only opened my account with $3,000 and the AAPL and TSLA puts tied up a good portion of my trading funds until they have time to move in position with your strategy.

I don’t have $25,000 to put in play, which was your suggestion. Of course, I’m not talking about being “all-in” as this is just the portion allotted to trading. So, all my bases are covered but I’m just trying to decide if that is a feasible move for me.

– Rick G.

Thanks for sending in your thoughts! If you have any questions or comments, then you can always send them to [email protected].