|

Larry’s note: Welcome to Trading with Larry Benedict, the brand new free daily eletter, designed and written to help you make sense of today’s markets. I’m glad you can join us. My name is Larry Benedict. I’ve been trading the markets for over 30 years. I got my start in 1984, working in the Chicago Board Options Exchange. From there, I moved on to manage my own $800 million hedge fund, where I had 20 profitable years in a row. And, I’ve been featured in the book Market Wizards, alongside investors like Paul Tudor Jones. But these days, rather than just trading for billionaires, I spend a large part of my time helping regular investors make money from the markets. My goal with these essays is to give you insight on the most interesting areas of the market for traders right now. Let’s get right into it… |

On Tuesday, Federal Reserve Chair Jerome Powell finally conceded that inflation is no longer transitory.

It took him long enough…

With inflation having risen more than four-fold since the start of the year – and 0.9% last month alone – the Fed knows that it’s going to take more than wishful thinking to get it back under control.

And that means the Fed’s tapering of bond buying could happen sooner (and by a larger amount) than people think…

At its next meeting on December 14-15 (the last one for the year), there’s a chance the Federal Open Market Committee (FOMC) will announce that its bond buying program could finish as early as March, if not sooner (having only last month scheduled it for June).

A big part of the speed of that tapering relies on upcoming economic data…

The next round of inflation data is due a week from today (Friday, December 10). In the meantime, speculation is only going to intensify about how the Fed will respond.

A higher inflation number could force the Fed to drastically reduce (if not eliminate) its asset purchasing (bond buying) program altogether.

Of course, while that would reduce liquidity in the system and take some heat out of the economy, that would still leave the Fed on its backfoot playing catch-up in its attempts to reel in inflation.

But more importantly, let’s take a look at the effect on interest rates…

The markets know that rate rises are coming, we just don’t know when.

A few months ago, there seemed to be a slim chance of a single rate rise next year. Now, the markets are already starting to price in two, and possibly three, rises before the end of 2022.

As we discussed back in October, interest rates directly affect how the market values companies. A rise in interest rates would impact growth (or tech) stocks more than industrial stocks.

Given that growth stocks have carried this bull market since May 2021, this has major implications for the markets. Falling values in tech and other growth stocks would also drag the broader market down.

However, any increase in interest rates has wider ramifications than just the stock market… It’ll also have a huge bearing on the property market.

Just like the stock market, the property market has also been on a tear…

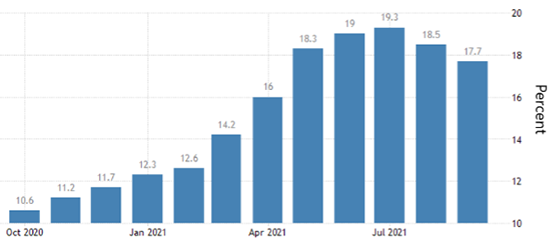

On Tuesday, the latest data (as of July 2021) showed that house prices had grown year-over-year (YoY) at 17.7%. That’s a handy return in any asset class, particularly in residential property considering historic returns.

As the table below shows, while that recent growth number is just 1.6% below its July high, it’s the lowest growth number since April.

United States House Price Index YoY

Source: TradingEconomics.com, Federal Housing Finance Agency

That tells me that the property market is already cooling in anticipation of higher interest rates. But the latest number is still a long way above where we were at the start of the year.

If this lower growth trend continues, that will take a lot of heat out of the economy.

While the Fed would still need to raise rates, it would be by a lesser extent. This could be a positive for the stock market given its reliance on high-growth stocks (and their sensitivity to higher rates).

One thing’s for sure, with the Fed’s big pivot this week on monetary policy and key inflation data ahead, it’s going to be a busy time in the markets as we head into the end of the year.

Regards,

Larry Benedict

Editor, Trading With Larry Benedict

Reader Mailbag

I always look forward to receiving feedback from avid readers. Here are some of the latest responses…

I really appreciate reading your analysis. It’s helping me train my ‘trading mind.’ Thank you.

– Vernon

Your site is very useful! Thank you.

– Keiniv

Thank you for your clear and concise daily writing. It helps immensely to understand the different market sectors and reading their charts.

– Jason

Thank you for sending daily market updates, they’re really insightful.

– Vin

P.S. We’re excited to hear what you think of your new eletter, Trading With Larry Benedict. Let us know at [email protected].